Integration that Braspag offers to retailers, where payment data is securely trafficked, maintaining complete control over the checkout experience.

This method enables you to securely send your customer payment data directly to our system. Payment data such as card number and expiration date are stored in the Braspag environment, which is PCI DSS 3.2 certified.

It is ideal for retailers who demand a high degree of security without losing the identity of their page, allowing full customization on their checkout page.

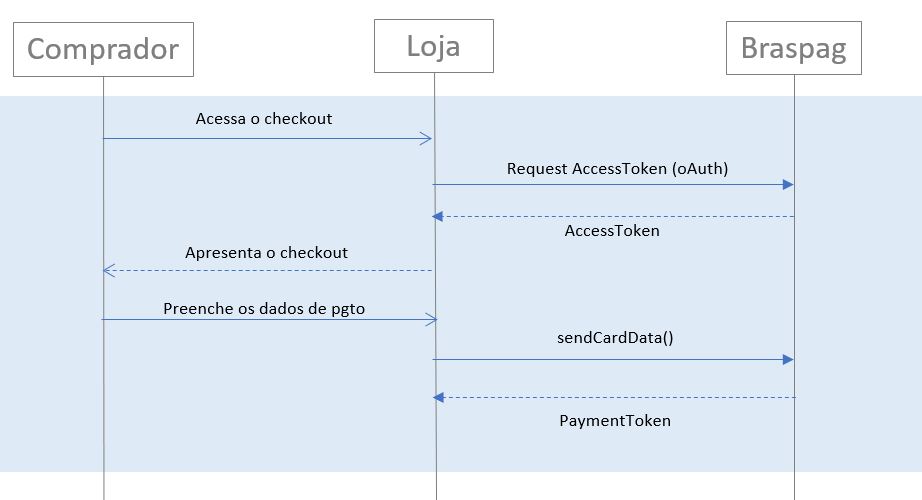

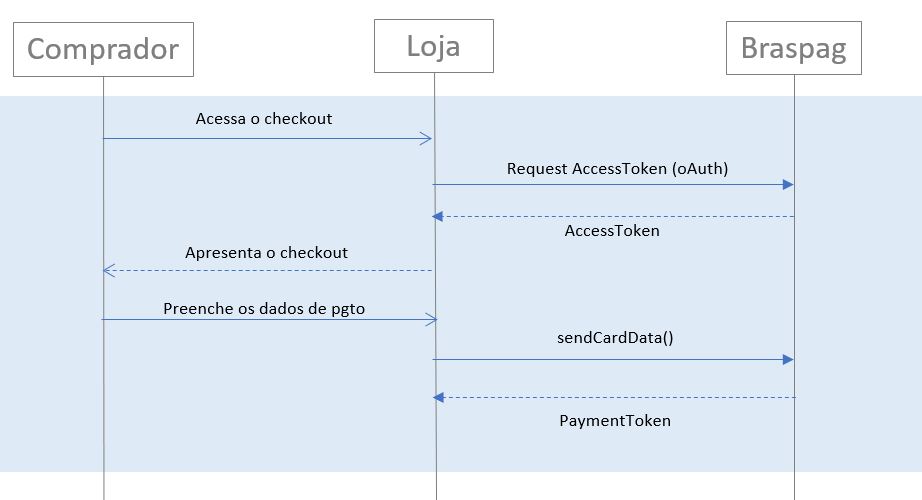

When the shopper accesses the checkout, the merchant must generate the AccessToken from Braspag Authentication API (oAuth). On success, the API will return an AccessToken that must be populated in the script to load on the page.

To request AccessToken, send a request (POST) to the following endpoint in the server-to-server template:

| Environment | base URL + endpoint | Authorization |

|---|---|---|

| SANDBOX | https://authsandbox.braspag.com.br/oauth2/token | “Basic {base64}” |

| PRODUCTION | https://auth.braspag.com.br/oauth2/token | “Basic {base64}” |

How to obtain the Base64 value:

ClientId:ClientSecret).To request your “ClientID” and “ClientSecret”, please contact our Support:

- MerchantId;

- Describe that you need the credentials “ClientID” e o “ClientSecret” to use Silent Order Post.

--request POST "https://authsandbox.braspag.com.br/oauth2/token"

--header "Authorization: Basic {base64}"

--header "Content-Type: application/x-www-form-urlencoded"

--data-binary "grant_type=client_credentials"

| Parameters | Format | Where to send |

|---|---|---|

Authorization |

“Basic {base64}” | Header. |

Content-Type |

“application/x-www-form-urlencoded” | Header. |

grant_type |

“client_credentials” | Body. |

{

"access_token": "faSYkjfiod8ddJxFTU3vti_ ... _xD0i0jqcw",

"token_type": "bearer",

"expires_in": 599

}

{

"access_token": "faSYkjfiod8ddJxFTU3vti_ ... _xD0i0jqcw",

"token_type": "bearer",

"expires_in": 599

}

| Properties | Description |

|---|---|

access_token |

The requested authentication token, that will be used in the next step. |

token_type |

Indicates the token type value. |

expires_in |

Access Token expiration, in seconds. When the token expires, you must request a new one. |

After obtaining AccessToken OAuth2, you should send a new request (POST) to the following URL:

| Environment | base URL + endpoint |

|---|---|

| Sandbox | https://transactionsandbox.pagador.com.br/post/api/public/v2/accesstoken |

| Production | https://transaction.pagador.com.br/post/api/public/v2/accesstoken |

--request POST "https://transactionsandbox.pagador.com.br/post/api/public/v2/accesstoken"

--header "Content-Type: application/json"

--header "MerchantId: XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX"

--header "Authorization: Bearer faSYkjfiod8ddJxFTU3vti_ ... _xD0i0jqcw"

--data-binary

--verbose

| Properties | Description | Type | Size | Required? |

|---|---|---|---|---|

MerchantId |

Merchant identifier at Pagador. | GUID | 36 | Yes |

Authorization |

Bearer [AccessToken OAuth2] | Text | 36 | Yes |

As a response, you will receive a JSON (“HTTP 201 Created”) with the SOP AccessToken and some other data.

{

"MerchantId": "XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"AccessToken": "MzA5YWIxNmQtYWIzZi00YmM2LWEwN2QtYTg2OTZjZjQxN2NkMDIzODk5MjI3Mg==",

"Issued": "2021-05-05T08:50:04",

"ExpiresIn": "2021-05-05T09:10:04"

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantId": "XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX",

"AccessToken": "MzA5YWIxNmQtYWIzZi00YmM2LWEwN2QtYTg2OTZjZjQxN2NkMDIzODk5MjI3Mg==",

"Issued": "2021-05-05T08:50:04",

"ExpiresIn": "2021-05-05T09:10:04"

}

| Properties | Description | Type | Size | Format |

|---|---|---|---|---|

MerchantId |

Merchant identifier at Pagador. | Guid | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

AccessToken |

AccessToken SOP. For safety reasons, this token will allow the merchant to save only one card within the deadline determined in the response, through the attribute Expires In. The default is 20 minutes. Whatever happens first will invalidate the token to prevent it from being used again. | Texto | – | NjBhMjY1ODktNDk3YS00NGJkLWI5YTQtYmNmNTYxYzhlNjdiLTQwMzgxMjAzMQ== |

Issued |

Token creation date and hour. | Texto | – | AAAA-MM-DDTHH:MM:SS |

ExpiresIn |

Token expiration date and hour. | Texto | – | AAAA-MM-DDTHH:MM:SS |

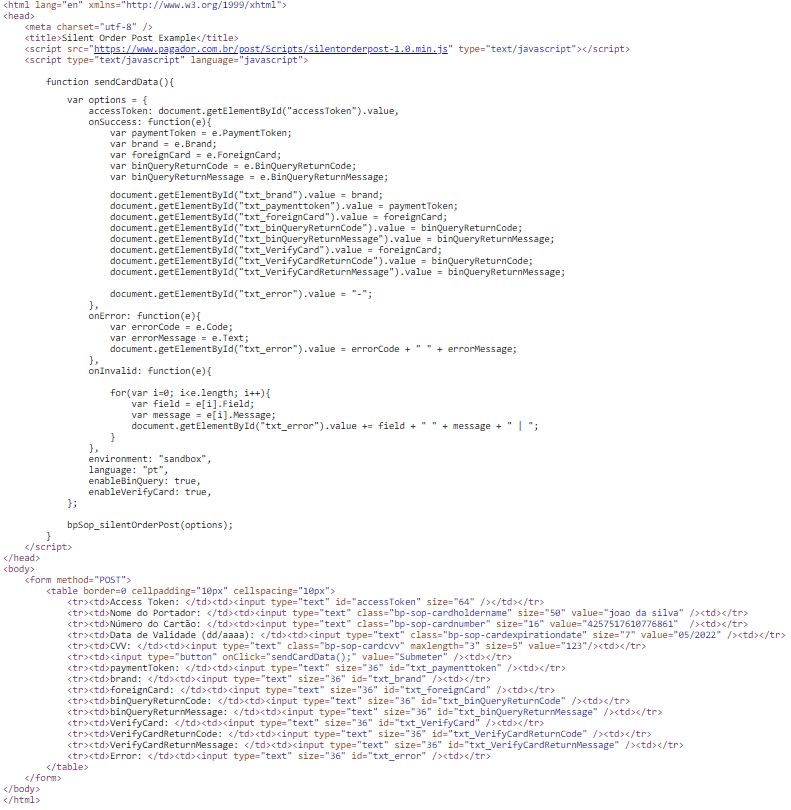

The establishment must download the script provided by Braspag, and attach it to their checkout page. This script will allow Braspag to process all card information without merchant intervention. The download can be done from the following URL:

The establishment shall parameterize the form elements with the following classes:

| Property | Class Name |

|---|---|

| Credit/Debit Cardholder Name | bp-sop-cardholdername |

| Credit/Debit Card Number | bp-sop-cardnumber |

| Credit/Debit Card Expiration Date | bp-sop-cardexpirationdate |

| Credit/Debit Card Security Code | bp-sop-cardcvvc |

SCRIPT PARAMETERS

| Property | Description |

|---|---|

accessToken |

Access Token obtained via Braspag Authentication API |

environment |

sandbox or production |

language |

PT or EN or ES |

enableBinQuery |

true if you want to enable BIN Query (returns card characteristics). false otherwise. |

enableVerifyCard |

true if you want to enable ZeroAuth (returns if the card is valid or not). false otherwise. |

enableTokenize |

true if you want to save the card directly on your vault in the Cartão Protegido (retorn a ‘cardToken’ instead of a ‘paymentToken’). false otherwise. |

cvvRequired |

“false” (unables CVV as required) / “true” (CVV is required). |

SCRIPT RESPONSE

| Property | Description | |

|---|---|---|

PaymentToken |

Payment Token in the Format of a GUID (36) | |

CardToken |

Permanent token to be used on a payment request on a GUID format (36) Obs.: Only works if ‘enableTokenize’ is true | |

brand |

Returned when enableBinQuery option is true. Card Brand Name (Visa, Master, Bond, Amex, Diners, JCB, Hipercard) | |

forerignCard |

Returned when enableBinQuery option is true. The field returns true if it is a card issued outside Brazil. false otherwise | |

binQueryReturnCode |

Returned when enableBinQuery option is true. “00” if BIN parsing is successful. | |

binQueryReturnMessage |

Returned when enableBinQuery option is true. E.g. “Authorized Transaction” if BIN analysis succeeds | |

VerifyCardStatus |

Returned when enableVerifyCard option is true. Invalid Card 0; 1-Valid Card; 99-Unknown Situation | |

VerifyCardReturnCode |

Returned when enableVerifyCard option is true. Zero Auth query code returned by the provider. | |

BinQueryReturnMessage |

Returned when enableBinQuery option is true. This is the same code returned by the provider during a standard authorization. E.g.: Cielo30 provider code “00” means validation success | |

BinQueryReturnMessage |

Returned when enableBinQuery option is true. E.g. “Authorized Transaction” | |

CardBin |

Returned when enableBinQuery option is true. E.g. “455187” | |

CardLast4Digits |

Returned when enableBinQuery option is true. E.g. “0181” | |

Issuer |

Returns the card issuer. | Returned when enableBinQuery is “true”. Available for Cielo 3.0 only. |

IssuerCode |

Returns the card issuer code. | Returned when enableBinQuery is “true”. Available for Cielo 3.0 only. |

CardType |

Returns the card type, E.g.: Credit, Debit, Multiple, Voucher etc. | Returned when enableBinQuery is “true”. Available for Cielo 3.0 only. |

VerifyCardReturnCode |

It is the same code returned by the provider during a standard authorization. E.g.: code “00” for provider Cielo30 means succesful validation. | Returned when enableBinQuery is “true”. Available for Cielo 3.0 only. |

VerifyCardReturnMessage |

E.g.: “Transacao Autorizada”/”Authorized Transaction”. | Returned when enableBinQuery is “true”. Available for Cielo 3.0 only. |

VerifyCardStatus |

“0”- Invalid Card; “1”- Valid Card; “99”- Unknown Situation. | Returned when enableBinQuery is “true”. |

The script provided by Braspag provides three events for handling and managed by the merchant.

| Event | Description |

|---|---|

| onSuccess | Event on success. PaymentToken will be returned, as well as card details if you have requested to verify the card. For security reasons this PaymentToken may only be used for authorization. After processing it will be invalidated. |

| onError | Event on error. Error code and description will be returned |

| onInvalid | Event in case of incorrect data supply. Error field details will be returned. Messages returned in the validation result are available in the following languages: Portuguese (default), English and Spanish. |

Example of a parameterization on the checkout page:

To download the code, click here

After obtaining PaymentToken through the script, the authorization process is performed by sending PaymentToken in place of card data.

See example below, describing the submission of authentication data from the Pagador API authorization request. For more details on implementation, please visit: Pagador API:

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Card":{

"PaymentToken":"eedcb896-40e1-465b-b34c-6d1119dbb6cf"

}

}

}

curl

--request POST "https://apisandbox.braspag.com.br/v2/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--header "MerchantKey: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--data-binary

--verbose

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Card":{

"PaymentToken":"eedcb896-40e1-465b-b34c-6d1119dbb6cf"

}

}

}

| Field | Description | Type | Size | Required |

|---|---|---|---|---|

Payment.Card.PaymentToken |

Provide the PaymentToken generated through the script. This information replaces the card data | GUID | 36 | Yes |

See https://braspag.github.io/manual/braspag-pagador{:target=”_blank”}

When the shopper accesses the checkout, the merchant must generate AccessToken from the Braspag Authentication API (oAuth). On success, the API will return an AccessToken that must be populated in the script to load on the page.

To request AccessToken, the establishment must POST to the following endpoint in the server-to-server template:

| Endpoint | Environment |

|---|---|

| https://transactionsandbox.pagador.com.br/post/api/public/v1/accesstoken?merchantid={mid} | Sandbox |

| https://transaction.pagador.com.br/post/api/public/v1/accesstoken?merchantid={mid} | Production |

In place of {mid} you must fill in the MerchantID of your store in Braspag’s Pagador platform.

Example: https://transactionsandbox.pagador.com.br/post/api/public/v1/accesstoken?merchantid=00000000-0000-0000-0000-000000000000

curl

--request POST "https://transactionsandbox.pagador.com.br/post/api/public/v1/accesstoken?merchantid=00000000-0000-0000-0000-000000000000"

--header "Content-Type: application/json"

--data-binary

--verbose

| Property | Description | Type | Size | Required |

|---|---|---|---|---|

mid |

Payer Store Identifier | GUID | 36 | Yes |

In response, the establishment will receive a json (HTTP 201 Created) containing among other information the ticket (AccessToken)

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantId": "B898E624-EF0F-455C-9509-3FAE12FB1F81",

"AccessToken": "MzA5YWIxNmQtYWIzZi00YmM2LWEwN2QtYTg2OTZjZjQxN2NkMDIzODk5MjI3Mg==",

"Issued": "2019-12-09T17:47:14",

"ExpiresIn": "2019-12-09T18:07:14"

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

MerchantId |

Pagador Store Identifier | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

AccessToken |

Access Token. For security reasons, this ticket will give the merchant permission to save only 1 card within the time limit stipulated in the response via the ExpiresIn attribute (by default 20 minutes). Whatever happens first will invalidate this same ticket for future use. | Text | – | NjBhMjY1ODktNDk3YS00NGJkLWI5YTQtYmNmNTYxYzhlNjdiLTQwMzgxMjAzMQ== |

Issued |

Date and time of generation | Text | – | AAAA-MM-DDTHH:MM:SS |

ExpiresIn |

Expiration Date and Time | Text | - | YYYY-MM-DDTHH:MM:SS |