(+) button by the title:

Continue:

Continue:

Register:

E-wallets are electronic safes (repositories) of cards and payment data for the physical and e-commerce customers. Digital wallets allow a customer to register their payment details, making the purchase process more convenient and secure.

Contact the provider of your choice for further information on how to contract the service.

Pagador currently supports the following digital wallets:

Card brands supported by the wallets

Vist the wallet website to know more about supported card brands:

GooglePay

ApplePay

SamsungPay

There are two options for sending an authorization request using the payment method e-wallet:

Wallet, the parameter WalletKey (used by Cielo to decrypt e-wallet data) and additional tokens provided by each e-wallet. This type of integration is recommended for merchants who are not PCI DSS compliant;Wallet and the merchant themselves decrypt e-wallet data and send the open data to authorization. This type of integration is recommended for merchants who are PCI DSS compliant.{

"MerchantOrderId": "2014111708",

"Customer":{

"Name": "Example Standard Wallet",

"Identity": "11225468954",

"IdentityType": "CPF"

},

"Payment":{

"Type":"CreditCard",

"Amount": 100,

"Provider": "Cielo",

"Installments":1,

"Currency":"BRL",

"Payment.Capture": "false",

"Wallet": {

"Type": "WALLET TYPE",

"WalletKey": "WALLET STORE ID",

"AdditionalData": {

"EphemeralPublicKey": "TOKEN INFORMED BY WALLET"

}

}

}

}

| Property | Description | Type | Size | Required |

|---|---|---|---|---|

MerchantId |

Store identifier at Braspag. (through header) | GUID | 36 | Yes |

MerchantKey |

Public key for dual authentication at Braspag. (through header) | Text | 40 | Yes |

RequestId |

Request identifier, used when the merchant uses different servers for each GET/POST/PUT. (through header) | GUID | 36 | No |

MerchantOrderId |

Order ID number. | Text | 50 | Yes |

Customer.Name |

Customer’s name. | Text | 255 | Yes |

Customer.Status |

Customer’s registration status (“NEW” / “EXISTING”). | Text | 255 | No |

Payment.Type |

Payment method type. | Text | 100 | Yes |

Payment.Amount |

Order amount in cents. | Number | 15 | Yes |

Payment.Provider |

Cielo providers only (“Cielo” / “Cielo30”). | Text | 15 | Yes |

Payment.Installments |

Number of installments. | Number | 2 | Yes |

Payment.Capture |

Indicates whether the authorization will use automatic capture (“true”) or not (“false”). If “false”, a capture request must be sent - please, check with the acquirer if pre-authorization is available. | Boolean | - | No (default “false”) |

Wallet.Type |

Wallet type: “ApplePay” / “SamsungPay” / “GooglePay”. | Text | – | Yes |

Wallet.WalletKey |

Cryptographic key that identifies stores in wallets. Refer to the WalletKey table in the ANNEXES for more information. | Text | – | Yes |

Wallet.AdditionalData.EphemeralPublicKey |

Token returned by wallet. Must be submitted in ApplePay integrations. | Text | – | Yes |

Wallet.AdditionalData.Signature |

Token returned by wallet. Must be submitted in GooglePay integrations. | Text | – | Yes |

WalletKey is the identifier used by Braspag to decrypt the payloads returned by an e-wallet.

Here is a list of the WalletKey formats to be passed \to the Pagador API:

| Wallet | Example | |

|---|---|---|

| Apple Pay | 9zcCAciwoTS+qBx8jWb++64eHT2QZTWBs6qMVJ0GO+AqpcDVkxGPNpOR/D1bv5AZ62+5lKvucati0+eu7hdilwUYT3n5swkHuIzX2KO80Apx/ SkhoVM5dqgyKrak5VD2/drcGh9xqEanWkyd7wl200sYj4QUMbeLhyaY7bCdnnpKDJgpOY6J883fX3TiHoZorb/QlEEOpvYcbcFYs3ELZ7QVtjxyr O2LmPsIkz2BgNm5f+JaJUSAOectahgLZnZR+easdhghrsa/E9A6DwjMd0fDYnxjj0bQDfaZpBPeGGPFLu5YYn1IDc |

|

| Samsung Pay | eyJhbGciOiJSU0ExXzUiLCJraWQiOiIvam1iMU9PL2hHdFRVSWxHNFpxY2VYclVEbmFOUFV1ZUR5M2FWeHBzYXVRPS IsInR5cCI6IkpPU0UiLCJjaGFubmVsU2VjdXJpdHlDb250ZXh0IjoiUlNBX1BLSSIsImVuYyI6IkExMjhHQ00ifQ.cCsGbqgFdzVb1jhXNR –gApzoXH-fdafddfa-Bo_utsmDN_DuGm69Kk2_nh6txa7ML9PCI59LFfOMniAf7ZwoZUBDCY7Oh8kx3wsZ0kxNBwfy LBCMEYzET0qcIYxePezQpkNcaZ4oogmdNSpYY-KbZGMcWpo1DKhWphDVp0lZcLxA6Q25K78e5AtarR5whN4HUAkurQ.CFjWpHkAVoLCG8q0.NcsTuauebemJXmos_mLMTyLhEHL- p5Wv6J88WkgzyjAt_DW7laiPMYw2sqRXkOiMJLwhifRzbSp8ZgJBM25IX05dKKSS4XfFjJQQjOBHw6PYtEF5pUDMLHML3jcddCrX07abfef_DuP41PqOQYsjwesLZ8XsRj- R0TH4diOZ_GQop8_oawjRIo9eJr9Wbtho0h8kAzHYpfuhamOPT718EaGAY6SSrR7t6nBkzGNkrKAmHkC7aRwe.AbZG53wRqgF0XRG3wUK_UQ |

|

| Google Pay | {“encryptedMessage”:”0mXBb94Cy9JZhMuwtrBhMjXb8pDslrNsN5KhcEqnowOINqJgjXHD36KcCuzpQQ4cDAe64ZLmk2N3UBGXsN9hMMyeMakXlidVmteE +QMaNZIor048oJqlUIFPD54B/ic8zCdqq3xnefUmyKQe0I03x57TcEA9xAT/E4x3rYfyqLFUAEtu2lT0GwTdwgrsT8pKoTldHIgP+wVNTjrKvJrB4xM/Bhn6JfcSmOzFyI6w37 mBU71/TK761nYOSxt7z1bNWSLZ4b8xBu1dlRgen2BSlqdafuQjV3UZjr6ubSvaJ8NiCh5FD/X013kAwLuLALMS2uAFS9j8cZ6R6zNIi13fK6Fe4ACbFTHw LzSNZjQiaRDb6MlMnY8/amncPIOXzpirb5ScIz8EZUL05xd+3YWVTVfpqgFo1eaaS+wZdUyRG0QEgOsr6eLBoH8d5lfV9Rx6XdioorUuT7s1Yqc0OJZO +fhBt6X0izE9hBGTexdZyg\u003d\u003d”,”ephemeralPublicKey”:”BMdwrkJeEgCOtLevYsN3MbdP8xbOItXiTejoB6vXy0Kn0ZM10jy4Aasd6jTSxtoxo TpFydLhj5kzoOhbw2OzZu0\u003d”,”tag”:”yAQIjWZ0VuCC7SWyYwc4eXOzpSUKhZduF9ip0Ji+Gj8\u003d”} |

This is the EphemeralPublicKey format to be passed to the Pagador API:

| Wallet | Example |

|---|---|

| Apple Pay | MFkwEwYHKoZIzj0CAQYIKoZIzj0DAQcDQgAEoedz1NqI6hs9hEO6dBsnn0X0xp5/DKj3gXirjEqxNIJ8JyhGxVB3ITd0E+6uG4W6Evt+kugG8gOhCBrdUU6JwQ== |

This is the Signature format to be passed to the Pagador API:

| Wallet | Example |

|---|---|

| Google Pay | MEUCIQCGQLOmwxe5eFMSuTcr4EcwSZu35fB0KlCWcVop6ZxxhgIgbdtNHThSlynOopfxMIxkDs0cLh2NFh5es+J5uDmaViA= |

{

"MerchantOrderId": "2014111703",

"Customer":{

"Name": "[Guest]"

},

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest": 0,

"Capture": false,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "453211* *** **1521",

"Holder": "BJORN IRONSIDE",

"ExpirationDate": "08/2020",

"SaveCard":"false",

"Brand":"Visa",

},

"Tid": "0319040817883",

"ProofOfSale": "817883",

"AuthorizationCode": "027795",

"Wallet": {

"Type": "WALLET TYPE",

"WalletKey": "WALLET STORE ID",

"Eci": 0,

"AdditionalData": {

"EphemeralPublicKey": "TOKEN INFORMED BY WALLET"

},

},

"SoftDescriptor": "123456789ABCD",

"Amount": 100,

"ReceivedDate": "2018-03-19 16:08:16",

"Status": 1,

"IsSplitted": false,

"ReturnMessage": "Operation Successful",

"ReturnCode": "4",

"PaymentId": "e57b09eb-475b-44b6-ac71-01b9b82f2491",

"Type": "CreditCard",

"Currency":"BRL",

"Country": "BRA",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491"

},

{

"Method": "PUT",

"Rel": "capture",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/capture"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/void"

}

]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

ProofOfSale |

Authorization number, identical to NSU. | Text | 6 | Alphanumeric |

Tid |

Transaction ID in the acquirer. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code. | Text | 6 | Alphanumeric |

SoftDescriptor |

Text to be printed on the bearer bank statement. Available for VISA/MASTER only - no special characters allowed. | Text | 13 | Alphanumeric |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ECI |

Electronic Commerce Indicator. Represents how secure a transaction is. | Text | 2 | E.g.: 7 |

Status |

Transaction status. | Byte | 2 | E.g.: 1 |

ReturnCode |

Return code from the acquirer. | Text | 32 | Alphanumeric |

ReturnMessage |

Return message from the acquirer. | Text | – | Alphanumeric |

Type |

Wallet type: “ApplePay” / “SamsungPay” / “GooglePay”. | Text | – | Alphanumeric |

WalletKey |

Cryptographic key that identifies stores in wallets. Check the WalletKey table in the ANNEXES for more information. | Text | – | See “WalletKey” table annexed |

AdditionalData.EphemeralPublicKey |

Token returned by wallet. Must be submitted in ApplePay integrations. | Text | – | See “EphemeralPublicKey” table annexed |

AdditionalData.Signature |

Token returned by wallet. Must be submitted in GooglePay integrations. | Text | – | See “Signature” table annexed |

If the merchant decrypts the payload received from the wallet and sends it to the the Gateway API for processing and authorization, they must use the following request model:

{

"MerchantOrderId": "6242-642-723",

"Customer": {

"Name": "Guilherme Gama",

"Identity": "11225468954",

"IdentityType": "CPF"

},

"Payment": {

"Type": "CreditCard",

"Amount": 1100,

"Provider": "Cielo",

"Installments": 1,

"CreditCard": {

"CardNumber":"4532********6521",

"Holder":"Guilherme Gama",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Master"

},

"Wallet": {

"Type": "Tipo de wallet",

"Eci":"7",

"Cavv":"AM1mbqehL24XAAa0J04CAoABFA=="

}

}

}

--request POST "https://apisandbox.braspag.com.br/v2/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

-- Envio de cartão

{

"MerchantOrderId": "6242-642-723",

"Customer": {

"Name": "Guilherme Gama",

"Identity": "11225468954",

"IdentityType": "CPF"

},

"Payment": {

"Type": "CreditCard",

"Amount": 1100,

"Provider": "Cielo",

"Installments": 1,

"CreditCard": {

"CardNumber":"4532********6521",

"Holder":"Guilherme Gama",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Master"

},

"Wallet": {

"Type": "Tipo de wallet",

"Eci":"7",

"Cavv":"AM1mbqehL24XAAa0J04CAoABFA=="

},

}

}

| Property | Type | Size | Required | Description |

|---|---|---|---|---|

MerchantId |

Guid | 36 | Yes | Store identifier atCielo. |

MerchantKey |

Text | 40 | Yes | Public key for dual authentication at Cielo. |

RequestId |

Guid | 36 | No | Request identifier, used when the merchant uses different servers for each GET/POST/PUT. |

MerchantOrderId |

Text | 50 | Yes | Order ID number. |

Customer.Name |

Text | 255 | No | Customer’s name. |

Customer.Status |

Text | 255 | No | Customer’s registration status (“NEW” / “EXISTING”). |

Payment.Type |

Text | 100 | Yes | Payment method type. |

Payment.Amount |

Number | 15 | Yes | Order amount in cents. |

Payment.Installments |

Number | 2 | Yes | Number of installments. |

CreditCard.CardNumber. |

Text | 19 | Yes | Customer’s card number |

CreditCard.SecurityCode |

Texto | 4 | Não | Security code printed on the back of the card. |

CreditCard.Brand |

Text | 10 | Yes | Card brand (Visa / Master / Amex / Elo / Aura / JCB / Diners / Discover / Hipercard / Hiper). |

Wallet.Type |

Text | 255 | Yes | Wallet type: AndroidPay / ApplePay / SamsungPay |

Wallet.Walletkey |

Text | 255 | Yes | Cryptographic key representing card data. Consult the table WalletKey for more information. |

Wallet.Eci |

Text | 3 | Yes | The ECI (Electronic Commerce Indicator) represents how safe a transaction is. This value must be taken into account by the merchant when deciding on capturing the transaction. |

Wallet.Cavv |

Text | 255 | Yes | Validation field returned by Wallet and used as authorization basis. |

{

"MerchantOrderId": "2014111703",

"Customer": {

"Name": "[Guest]"

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": 0,

"Capture": false,

"Authenticate": false,

"Recurrent": false,

"CreditCard": {

"CardNumber": "453211******1521",

"Holder": "Gama Gama",

"ExpirationDate": "08/2020",

"SaveCard": false,

"Brand": "Visa"

},

"Tid": "0319040817883",

"ProofOfSale": "817883",

"AuthorizationCode": "027795",

"Wallet": {

"Type": "TIPO DE WALLET",

"Eci": 0

},

"SoftDescriptor": "123456789ABCD",

"Amount": 100,

"ReceivedDate": "2018-03-19 16:08:16",

"Status": 1,

"IsSplitted": false,

"ReturnMessage": "Operation Successful",

"ReturnCode": "4",

"PaymentId": "e57b09eb-475b-44b6-ac71-01b9b82f2491",

"Type": "CreditCard",

"Currency": "BRL",

"Country": "BRA",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491"

},

{

"Method": "PUT",

"Rel": "capture",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/capture"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/void"

}

]

}

}

In this topic, we present integration examples with the main e-wallets available on the market. The examples comprehend the scenario for encrypted cards, in which WalletKey and other token identifiers are required in the authorization.

If the merchant will send the authorization request with decrypted card data, please refer to Decrypted card.

Apple Pay is a digital wallet. It allows shoppers to make payments in e-commerce stores and apps in a safe and easy way, using credit and debit cards stored in their Apple account and devices.

In order to use Apple Pay, your store must be previously registered in the AppleID program. In addition to that, you must also:

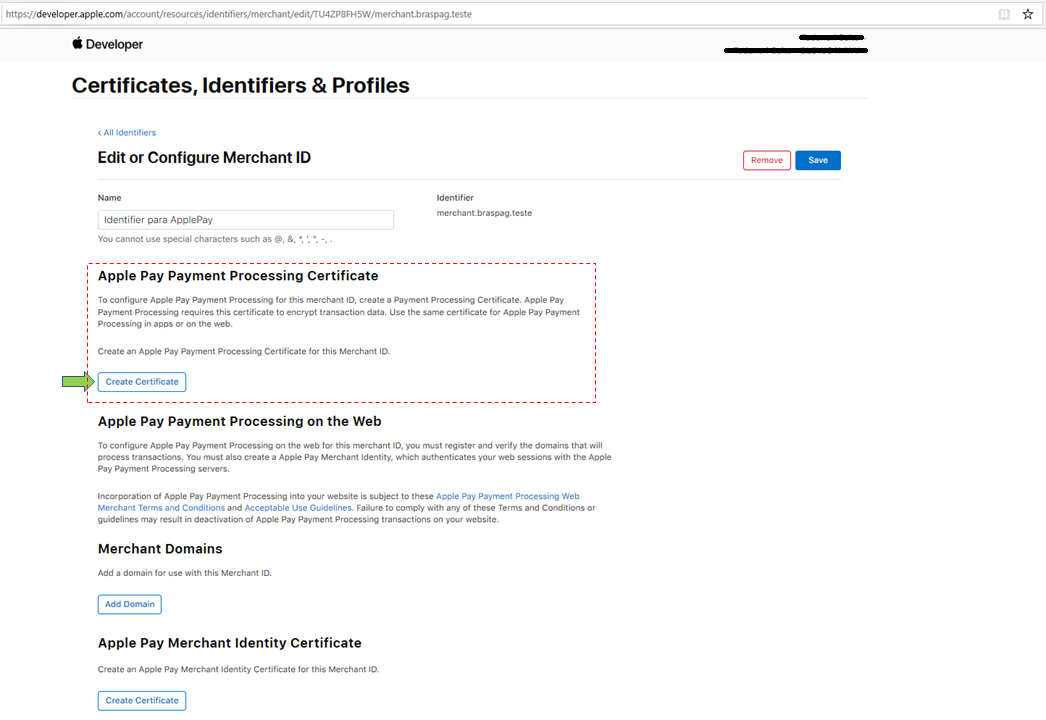

To begin with, you must create a merchant identifier for your store. After that, the merchant identifier must be sent to Braspag in request for a “.CSR” certificate. The “.CSR” certificate created by Braspag must be used to create the new “.CER” certificate, in Apple. This “.CER” certificate will be used to proceed to the second part of the process.

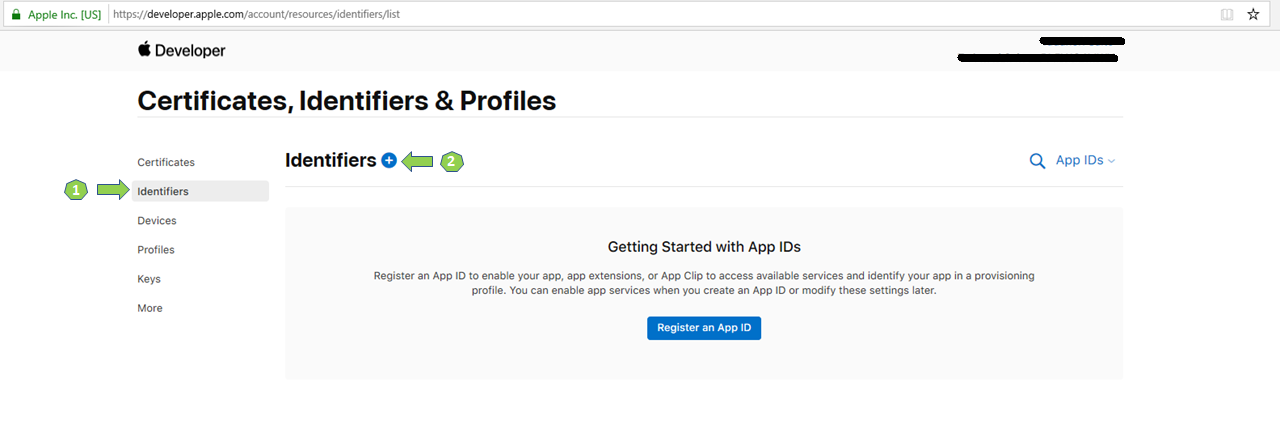

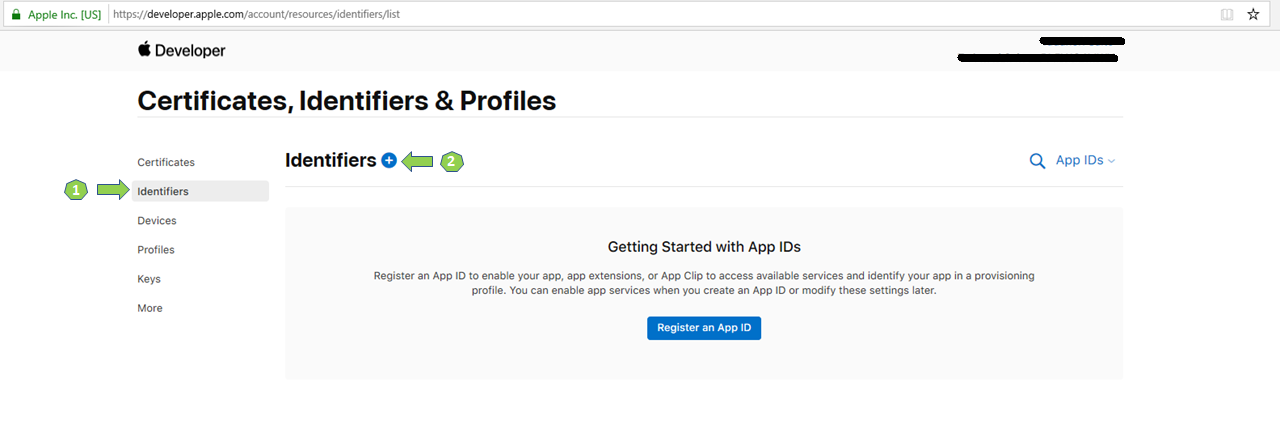

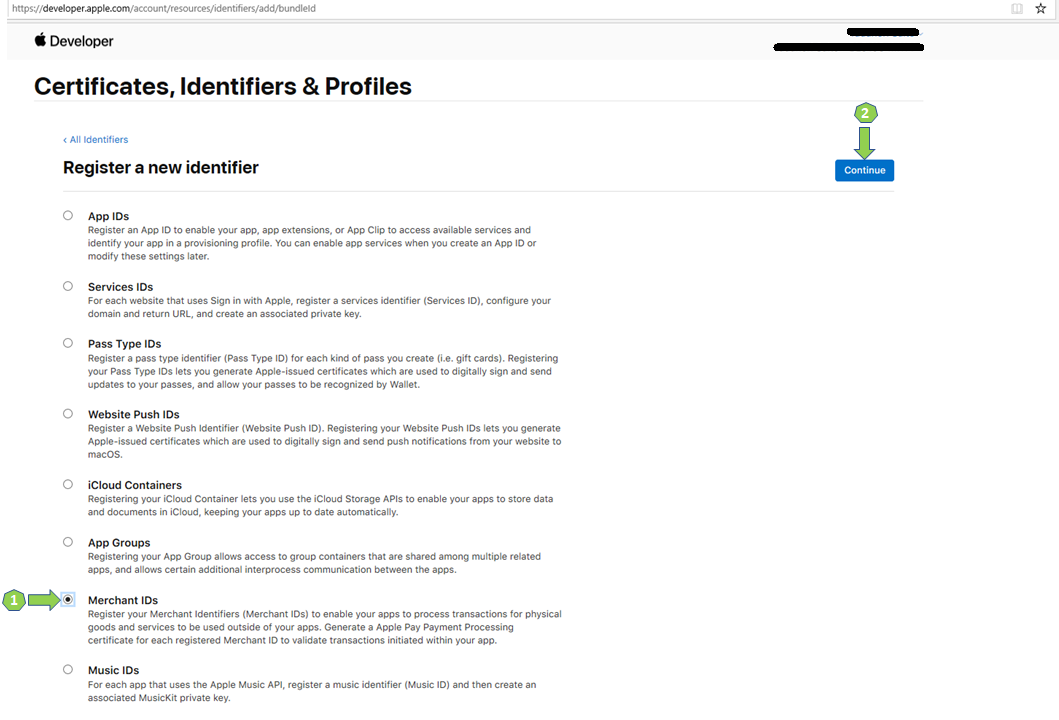

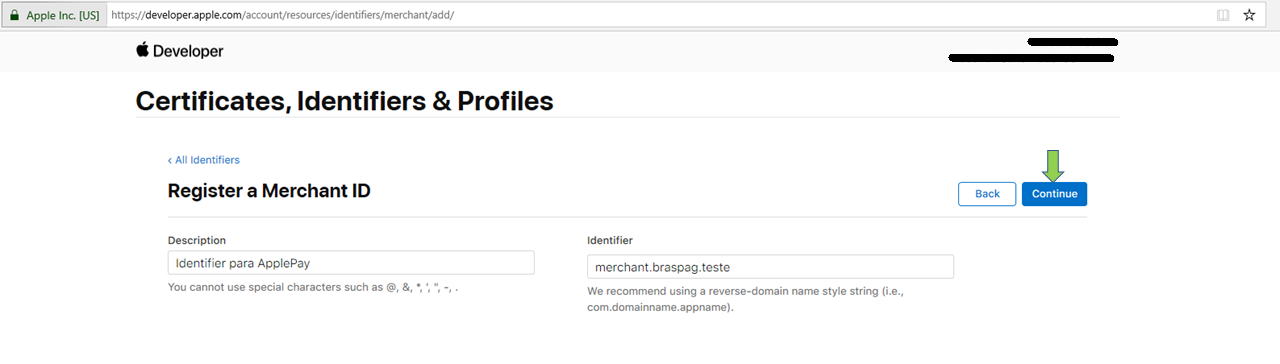

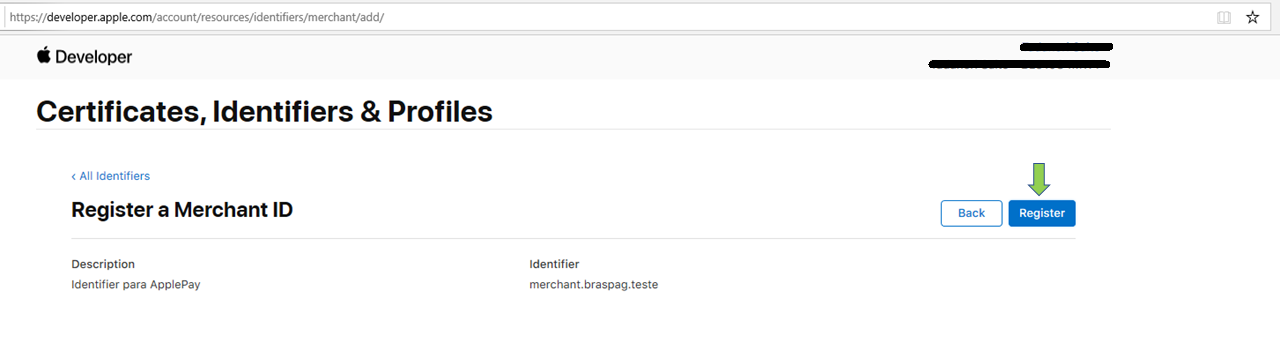

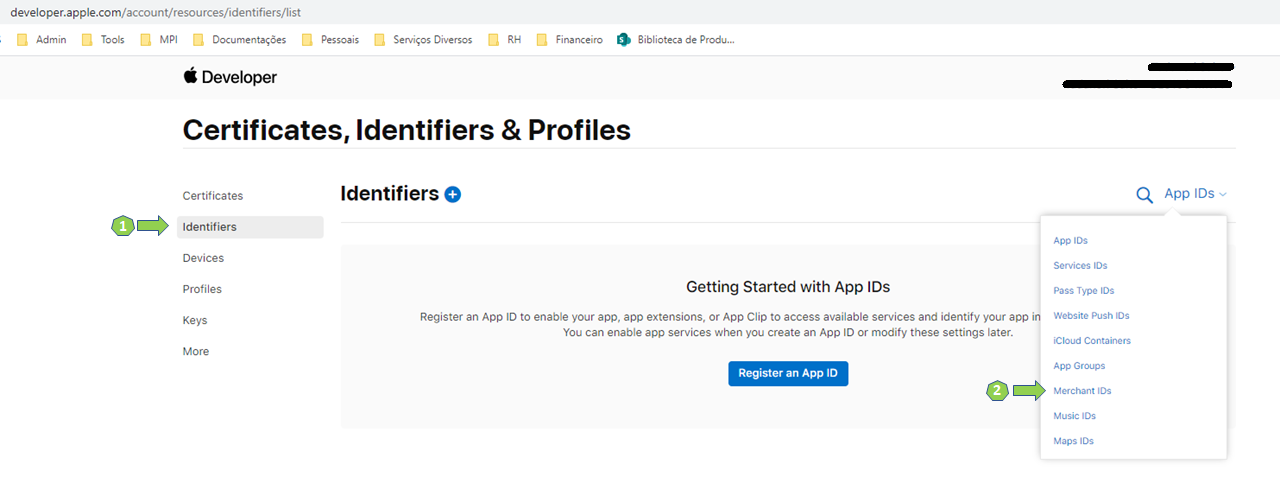

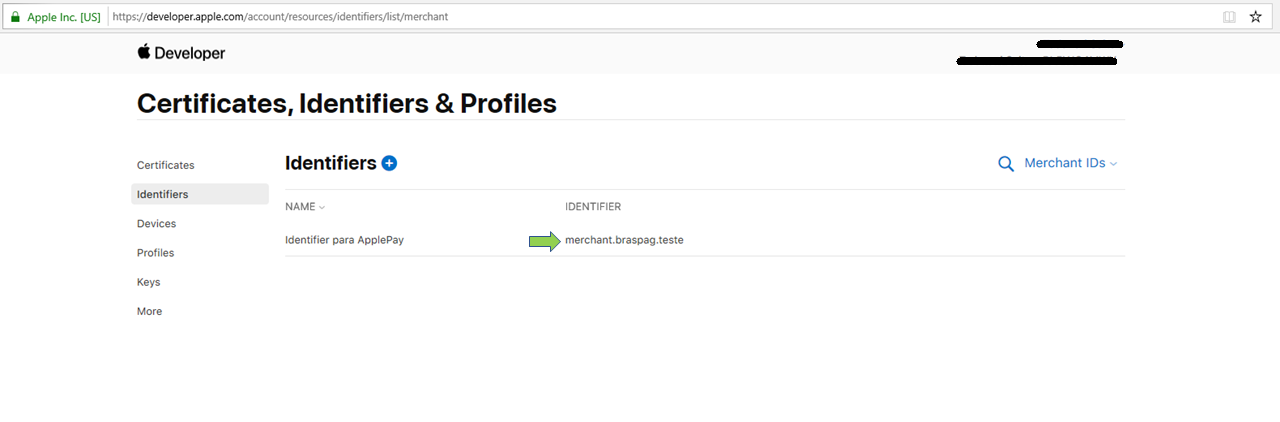

The merchant identifier must be created through the Apple Developer website as follows:

(+) button by the title:

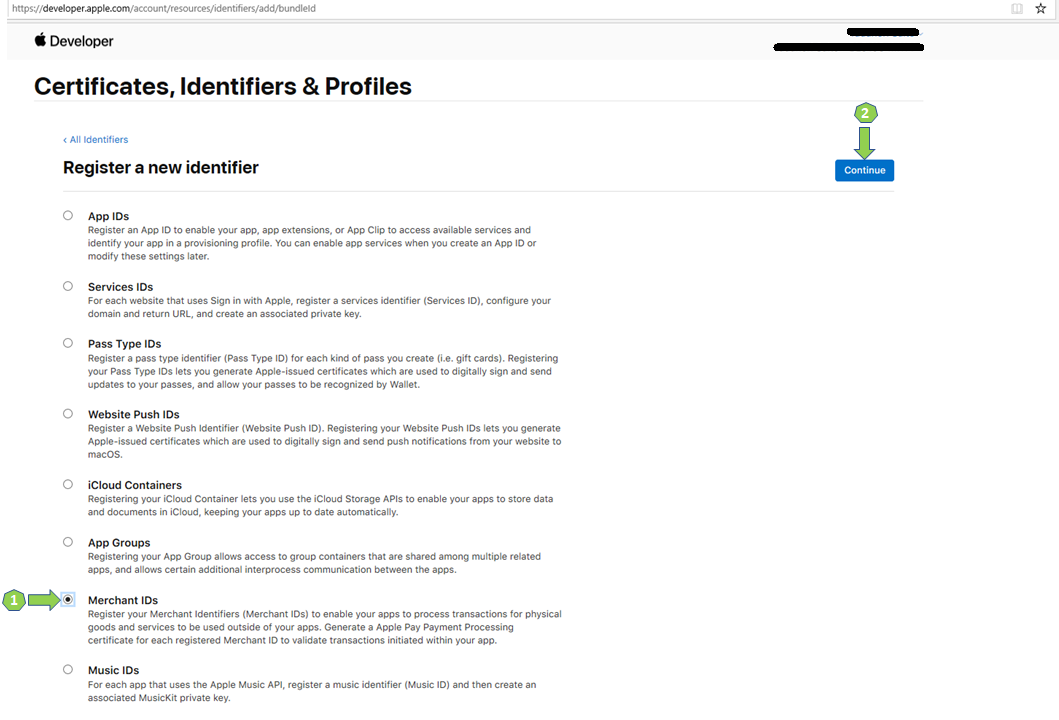

Continue:

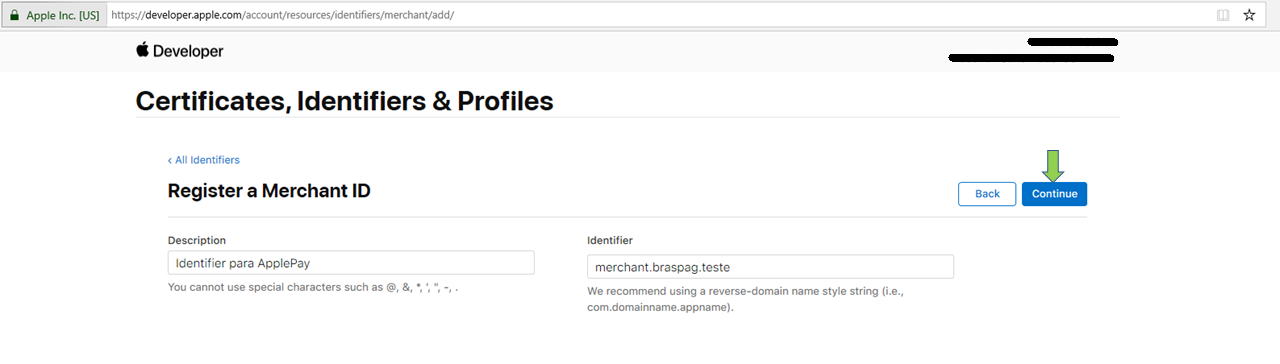

Continue:

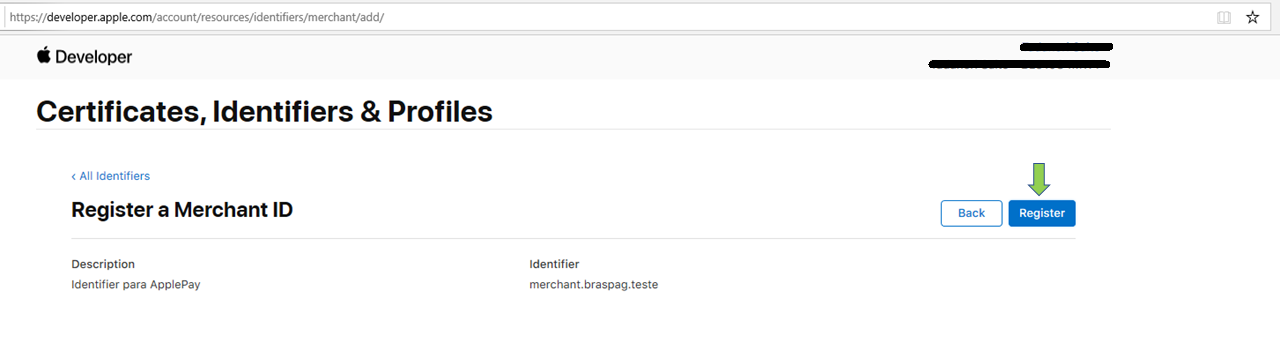

Register:

To send Braspag a request for a certificate in the “.CSR” format, contact our Support Team informing the following:

Our team will get back to you with the “.CSR” file in up to 48 working hours.

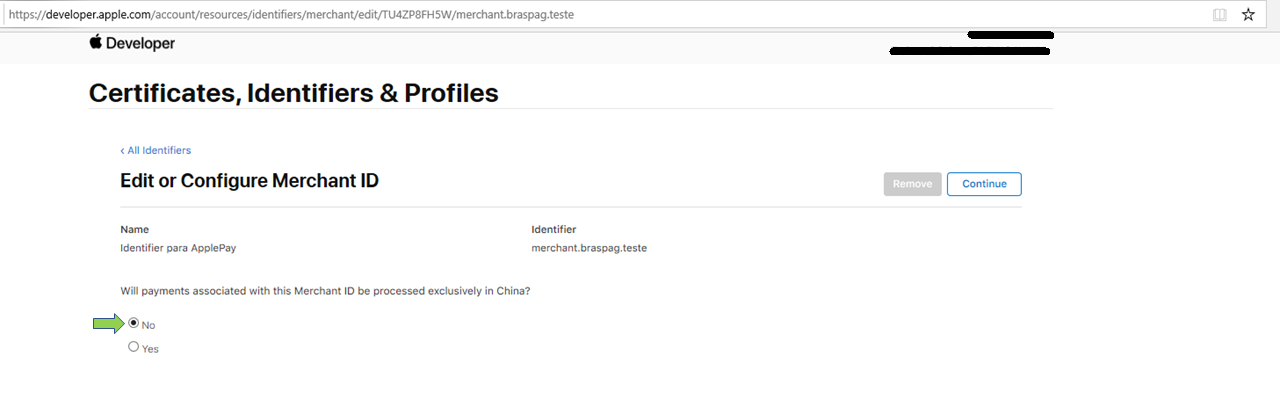

To create a payment processing certificate (“.CER”) to be used in your virtual store or app, you must enter the Apple Developer website and follow the procedure below:

Create Certificate button right after the short description:

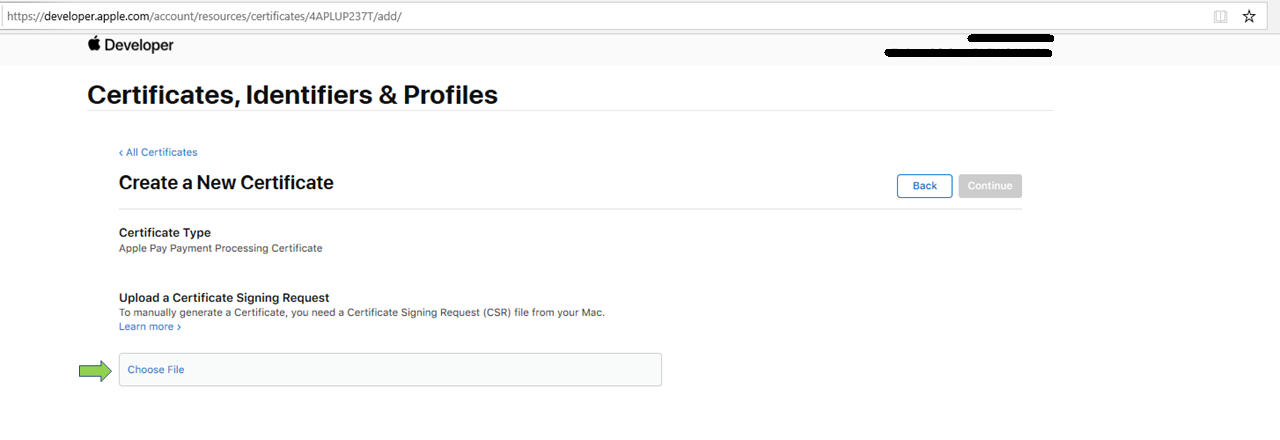

Choose File and choose the “.CSR” certificate sent by Braspag:

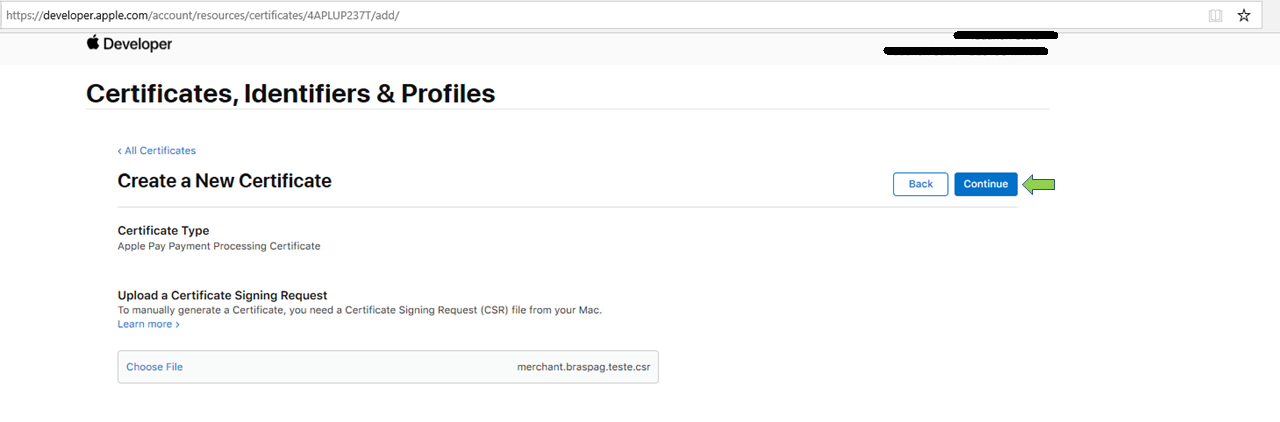

Continue:

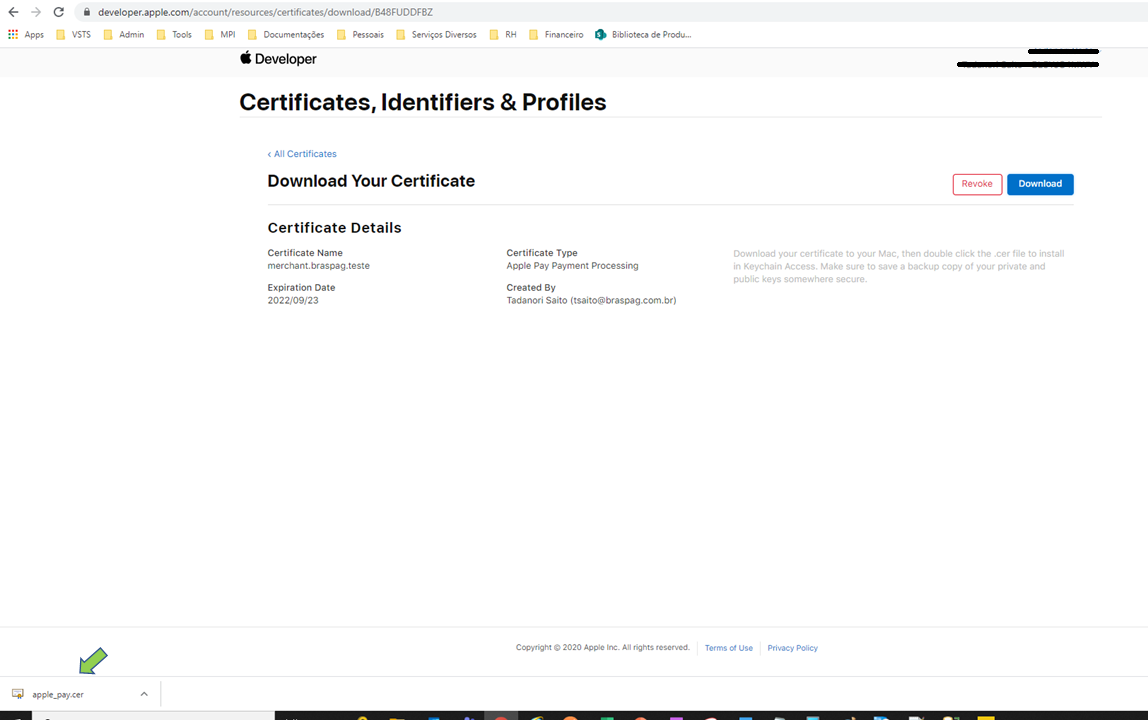

Download and save the “.CER” file:

For more details on the process, access Apple’s Developer Account Help.

Most of the process of enabling the “Pay with Apple Pay” button in your app or site is performed during your wallet integration. For that reason, we recommend you to follow the instructions available in the Apple Developer Documentation website for Apple’s self-service implementation.

At the end of the process performed in the Apple API, you will receive a JSON containing two important fields that will be used in “PART 3”: the paymentData.data and the ephemeralPublicKey.header.EphemeralPublicKey fields.

Check below an example of how Apple API may send the JSON:

{

"applePayData": {

"paymentData": {

"version": "EC_v1",

"data": "as01vRj+n9crY2vome7zc+u7Tz0+qg2La/8IUHpJIjFN6ThhUqLnSrskQHTrEbcYPiMksFK0+ddo9sZu70uJQJH1I+44N6PrVhilNDem97vOXq2VYDXiVJ27F/Q9wGQDgZBeGcZ6Pml9SIelHqUauBcQoOatrlnWPUL8kbdpT8WqgzXyaCh7oeTz=z6++rp/ofjvSjnGtOqAUsnrzvw4uzkcyKUSsfROdJ6B/Xzgu/T9fMIr5UxXD2DPF1SNh3ydEJABKz4HFjDW7ObvbQeua4GYxJdpQLpI3NgUbJy91E/LOyb/+PcCtO+0=a41tBrfnTTF9qsPuCIw8HWIEEKSRofn27NTofxev/i+nHEfqEtqNrN/epIvhzceD/gDiGetfiLKMzf94ARmpWUAMC==",

"signature": "(…)",

"header": {

"ephemeralPublicKey": "MFkwEwZJKoZIzj0CAQYIKo12zj0DAQcDQgAEo+ReGClSmQ4hDJD1yh9nci3V4l7kPm2AQtKZMMvuNS0iK5sn/1A9l3kw1B1xCqOycZmnPSng7p5hpTvrei1BCA==",

"publicKeyHash": "KXN06+BtJu6yEfF9zDhr7f4M/2HwVybnx0FGfC520gB=",

"transactionId": "71c5b61c3791546e94d2b4893a6c69aaac2ab86b5c113c83a7d89057906a9b5f"

}

},

"paymentMethod": {

"displayName": "MasterCard 1212",

"network": "MasterCard",

"type": "credit"

},

"transactionIdentifier": "81C5B61C3791646E94D2B4893A6C69BBBC2AB86B5C363C83A7D89057906A9BAC"

},

"x_document": "24562608994",

"x_name": "João da Silva"

}

The parameter

Payment.Wallet.WalletKeysent in Gateway authorization request should be filled with the value received from Apple inpaymentData.data.

Authorization with the Apple Pay token happens in the same way as standard credit card authorization. However, instead of transmitting the card data openly, you must provide the token received from Apple Pay, as shown in the example below:

{

"MerchantOrderId": "2017051002",

"Customer": {

(…)

},

"Payment": {

"Type": "CreditCard",

"Amount": 1000,

"Provider": "Cielo30",

"Installments": 1,

"Currency": "BRL",

"Wallet": {

"Type": "ApplePay",

"WalletKey":"['paymentData.data']",

"AdditionalData": {

"EphemeralPublicKey": "['ephemeralPublicKey.header.EphemeralPublicKey']"

}

}

}

}

| Header Parameters | Description | Type and Size |

|---|---|---|

MerchantId |

Store ID in Pagador. | GUID (36) |

MerchantKey |

API key in Pagador. | String (24) |

| Parameter | Description | Type and Size |

|---|---|---|

MerchantOrderId |

Order ID number. | String (50) |

Customer |

Node with customer’s data. | Refer to the Pagador Guide. |

Payment.Type |

Payment method type. Possibilities: “CreditCard” / “DebitCard”. | String (100) |

Payment.Amount |

Order amount in cents. | Number (15) |

Payment.Provider |

Name of payment method provider. For Apple Pay transactions, use “Cielo30”. | String (15) |

Payment.Installments |

Number of installments. | Number (2) |

Payment.Wallet.Type |

Name of payment method provider. For Apple Pay transactions, use “ApplePay”. | String (15) |

Payment.Wallet.WalletKey |

Fill with the paymentData.data parameter value returned by Apple Pay. |

String |

Payment.Wallet.AdditionalData.EphemeralPublicKey |

Fill with the ephemeralPublicKey.header.EphemeralPublicKey parameter value returned by Apple Pay. |

String |

{

"MerchantOrderId": "2017051002",

"Customer": {(…)

},

"Payment": {

(…)

"CreditCard": {

(…)

},

(…)

"Wallet": {

"Type": "ApplePay",

"WalletKey": "as01vRj+n9crY2vome7zc+u7Tz0+qg2La/8IUHpJIjFN6ThhUqLnSrskQHTrEbcYPiMksFK0+ddo9sZu70uJQJH1I+44N6PrVhilNDem97vOXq2VYDXiVJ27F/Q9wGQDgZBeGcZ6Pml9SIelHqUauBcQoOatrlnWPUL8kbdpT8WqgzXyaCh7oeTz=z6++rp/ofjvSjnGtOqAUsnrzvw4uzkcyKUSsfROdJ6B/Xzgu/T9fMIr5UxXD2DPF1SNh3ydEJABKz4HFjDW7ObvbQeua4GYxJdpQLpI3NgUbJy91E/LOyb/+PcCtO+0=a41tBrfnTTF9qsPuCIw8HWIEEKSRofn27NTofxev/i+nHEfqEtqNrN/epIvhzceD/gDiGetfiLKMzf94ARmpWUAMC==",

"AdditionalData": {

"EphemeralPublicKey": "MFkwEwZJKoZIzj0CAQYIKo12zj0DAQcDQgAEo+ReGClSmQ4hDJD1yh9nci3V4l7kPm2AQtKZMMvuNS0iK5sn/1A9l3kw1B1xCqOycZmnPSng7p5hpTvrei1BCA=="

}

},

(…)

"Links": [

(…)

]

}

}

The authorization response returned by the wallet will have the same fields shown in our Pagador documentation, but with the addition of the Payment.Wallet node repeating the same fields used in the authorization, as described above.

Google Pay is an e-wallet. It allows shoppers to make payments in e-commerce stores and apps using their credit and debit cards stored in their Google Account and Android devices in a safe and easy way.

In order to use Google Pay, your store must be previously registered and integrated with Google Pay. In addition to that, you must also:

Initially, you must configure your project and implement Google Pay in your Android app.

Follow the instructions described in the Google Pay Setup Guide.

In this step, you must add dependencies either by importing the Google Pay Services library or choosing the APIs you wish to compile. Then, you must follow the instructions and modify your project’s “AndroidManifest.xml” file accordingly.

To integrate Google Play into your app, follow all the steps described in the Google Pay Tutorial Guide.

For an accurate integration of Google Pay using Braspag’s payment gateway, the following points must be carefully considered:

In “Step 2: Choose a payment tokenization method”, follow the “GATEWAY” integration model and assign the “PAYMENT_GATEWAY” value to the type parameter and the “cielo” value to the gateway parameter, according to the example:

private static JSONObject getTokenizationSpecification() {

JSONObject tokenizationSpecification = new JSONObject();

tokenizationSpecification.put("type", "PAYMENT\_GATEWAY");

tokenizationSpecification.put(

"parameters",

new JSONObject()

.put("gateway", "cielo")

.put("gatewayMerchantId", "exampleMerchantId"));

return tokenizationSpecification;

}

Fill the gatewayMerchantId with the identifier generated for your store by the gateway. The merchant identifier has the “XXXXXXXX-XXXX-XXXX-XXXX-XXXXXXXXXXXX” format (type GUID / size 36).

In “Step 3: Define supported payment card networks”, proceed with the supported brands: “VISA”, “MASTERCARD”, “AMEX”, “DISCOVER” and “JCB”.

In “Step 5: Create a PaymentsClient instance”, use the “WalletConstants.ENVIRONMENT_TEST” value for test purposes.

In “Step 7: Create a PaymentDataRequest object”, use the “BRL” value for the currencyCode parameter. The merchantName field is the name that the buyer will see throughout the Google Pay payment process. Thus, the use of a friendly name is recommended.

In “Step 9: Handle the response object”, the Activity.RESULT_OK event is described, in which an object is returned with all the payment data, including payment tokens.

Use the getPaymentMethodToken() method to get the PaymentMethodToken object from PaymentData. Click here for details.

After obtaining the PaymentMethodToken, use the GetToken() method, from the PaymentMethodToken object in order to obtain the string that contains the payment tokens. Click here for details.

The string obtained has a similar structure to the one in the following example. Click here for further information.

{

"protocolVersion": "ECv1",

"signature": "TJVA95OrM7E2cBab30RMHrHDcEfxjoYZgeFONFh7HgQ",

"signedMessage": "{\"encryptedMessage\":

\"ZW5jcnlwdGVkTWVzc2FnZQ==\",\"ephemeralPublicKey\":

\"ZXBoZW1lcmFsUHVibGljS2V5\",\"tag\": \"c2lnbmF0dXJl\"}"

}

| Parâmetro | Type | Descrição |

|---|---|---|

signedMessage |

string | Base64-encoded encrypted message containing payment information and some additional security fields. |

signature |

string | Base64-encoded ephemeral public key associated with the private key to encrypt the message in uncompressed point format. |

(to see more details: https://developers.google.com/pay/api/android/guides/resources/payment-data-cryptography)

Hold the signedMessage and signature values. They will be requested in Braspag’s authorization process in PART 2, described ahead.

The authorization with the Google Pay token must be performed in the same way as a standard authorization for a credit card. Although, instead of openly providing the card data, the token received through Google Pay must be provided, as in the example.

{

"MerchantOrderId": "2014111708",

"Customer": {

(…)

},

"Payment": {

"Type": "CreditCard",

"Amount": 100,

"Provider": "Cielo30",

"Installments": 1,

"Wallet": {

"Type": "AndroidPay",

"WalletKey": "ZW5jcnlwdGVkTWVzc2FnZQ==",

"AdditionalData": {

"EphemeralPublicKey": "ZXBoZW1lcmFsUHVibGljS2V5"

}

}

}

}

| Header Parameters | Description | Type and Size |

|---|---|---|

MerchantId |

Store identifier at Cielo 3.0. For the Sandbox environment, use 63D6ACCB-2734-4236-AB5D-843A9DAC44C7. | GUID (36) |

MerchantKey |

API key for Cielo 3.0. For the Sandbox environment, use ZCVHDJWKTGOZXADDYJFURIDIKHEMRYQAQDYEJMQK. | String (24) |

| Parameters | Description | Type and Size |

|---|---|---|

MerchantOrderId |

Order identification number. | String (50) |

Customer |

Node with the buyer’s data. | Refer to the Pagador Guide. |

Payment.Type |

Payment method type. Possible values: “CreditCard” / “DebitCard”. | String (100) |

Payment.Amount |

Transaction amount in cents. | Number (15) |

Payment.Provider |

Payment method provider name. For Google Pay, use “Cielo30”. | String (15) |

Payment.Installments |

Number of installments. | Number (2) |

Payment.Wallet.Type |

Wallet provider name. For Google Pay, use “AndroidPay”. | String (15) |

Payment.Wallet.WalletKey |

Provide the signedMessage received from Google Pay. |

String |

Payment.Wallet.AdditionalData. EphemeralPublicKey |

Provide the signature received from Google Pay. |

String |

For further information, refer to the Pagador Guide.

The wallet authorization response will have the same fields as the ones presented in our Pagador documentation. The response will be added of the Payment.Wallet node, which will repeat the same fields used in the request and described above.

In order to complete the process, first validate the steps performed in PARTS 1 and 2. Then, request your access credentials for deployment.

Verify whether the branding guidelines have been thoroughly followed.

Verify whether all items in the integration checklist have been completed.

After the validation in steps 1 and 2 is done, request your access credentials for the production environment.

Below is a prerequisite for using Samsung Pay, followed by an example of a request to make it available in your store.

The store must already have Samsung registration and integration before integrating with the Pagador API. For more information, refer to Samsung Pay documentation.

Example of a standard Samsung Pay request:

{

"MerchantOrderId":"6242-642-723",

"Customer":{

"Name": "Example Standard Wallet",

"Identity": "11225468954",

"IdentityType": "CPF"

},

"Payment":{

"Type":"CreditCard",

"Amount": 1,

"Provider": "Cielo",

"Installments":1,

"Currency":"BRL",

"Wallet":{

"Type":"SamsungPay",

"WalletKey":"eyJhbGciOiJSU0ExXzUiLCJraWQiOiIvam1iMU9PL2hHdFRVSWxHNFpxY2VYclVEbmFOUFV1ZUR5M2FWeHBzYXVRPSIsInR5cCI6IkpPU0UiLCJjaGFubmVsU2VjdXJpdHlDb250ZXh0IjoiUlNBX1BLSSIsImVuYyI6IkExMjhHQ00ifQ.cCsGbqgFdzVb1jhXNR--gApzoXH-LldMArSoG59x6i0BbI7jttqxyAdcriSy8q_77VAp3854P9kekjj54RKLrP6APDIr46DI97kjG9E99ONXImnEyamHj95ZH_AW8lvkfa09KAr4537RM8GEXyZoys2vfIW8zqjjicZ8EKIpAixNlmrFJu6-Bo_utsmDN_DuGm69Kk2_nh6txa7ML9PCI59LFfOMniAf7ZwoZUBDCY7Oh8kx3wsZ0kxNBwfyLBCMEYzET0qcIYxePezQpkNcaZ4oogmdNSpYY-KbZGMcWpo1DKhWphDVp0lZcLxA6Q25K78e5AtarR5whN4HUAkurQ.CFjWpHkAVoLCG8q0.NcsTuauebemJXmos_mLMTyLhEHL-p5Wv6J88WkgzyjAt_DW7laiPMYw2sqRXkOiMJLwhifRzbSp8ZgJBM25IX05dKKSS4XfFjJQQjOBHw6PYtEF5pUDMLHML3jcddCrX07abfef_DuP41PqOQYsjwesLZ8XsRj-R0TH4diOZ_GQop8_oawjRIo9eJr9Wbtho0h8kAzHYpfuhamOPT718EaGAY6SSrR7t6nBkzGNkrKAmHkC7aRwe.AbZG53wRqgF0XRG3wUK_UQ"

}

}

}

| Property | Description | Type | Size | Required |

|---|---|---|---|---|

MerchantId |

Store identifier at Braspag. | GUID | 36 | Yes (through header) |

MerchantKey |

Public key for dual authentication at Braspag. | Text | 40 | Yes (through header) |

RequestId |

Request identifier, used when the merchant uses different servers for each GET/POST/PUT. | GUID | 36 | No (through header) |

MerchantOrderId |

Order ID number. | Text | 50 | Yes |

Customer.Name |

Customer’s name. | Text | 255 | Yes |

Customer.Status |

Customer’s registration status (“NEW” / “EXISTING”). | Text | 255 | No |

Payment.Type |

Payment method type. | Text | 100 | Yes |

Payment.Amount |

Order amount in cents. | Number | 15 | Yes |

Payment.Provider |

Cielo providers only (“Cielo” / “Cielo30”). | Text | 15 | Yes |

Payment.Installments |

Number of installments. | Number | 2 | Yes |

Wallet.Type |

Wallet type: “ApplePay” / “SamsungPay” / “GooglePay”. | Text | 255 | Yes |

Wallet.WalletKey |

Cryptographic key that identifies stores in wallets. Check the WalletKey table in the ANNEXES for more information. | Text | 255 | Yes |

{

"MerchantOrderId": "2014111703",

"Customer":{

"Name": "[Guest]"

},

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest": 0,

"Capture": false,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "453211* *** **1521",

"Holder": "BJORN IRONSIDE",

"ExpirationDate": "08/2020",

"SaveCard":"false",

"Brand":"Visa",

},

"Tid": "0319040817883",

"ProofOfSale": "817883",

"AuthorizationCode": "027795",

"Wallet": {

"Type": "SamsungPay",

"WalletKey": "eyJhbGciOiJSU0ExXzUiLCJraWQiOiIvam1iMU9PL2hHdFRVSWxHNFpxY2VYclVEbmFOUFV1ZUR5M2FWeHBzYXVRPSIsInR5cCI6IkpPU0UiLCJjaGFubmVsU2VjdXJpdHlDb250ZXh0IjoiUlNBX1BLSSIsImVuYyI6IkExMjhHQ00ifQ.cCsGbqgFdzVb1jhXNR--gApzoXH-LldMArSoG59x6i0BbI7jttqxyAdcriSy8q_77VAp3854P9kekjj54RKLrP6APDIr46DI97kjG9E99ONXImnEyamHj95ZH_AW8lvkfa09KAr4537RM8GEXyZoys2vfIW8zqjjicZ8EKIpAixNlmrFJu6-Bo_utsmDN_DuGm69Kk2_nh6txa7ML9PCI59LFfOMniAf7ZwoZUBDCY7Oh8kx3wsZ0kxNBwfyLBCMEYzET0qcIYxePezQpkNcaZ4oogmdNSpYY-KbZGMcWpo1DKhWphDVp0lZcLxA6Q25K78e5AtarR5whN4HUAkurQ.CFjWpHkAVoLCG8q0.NcsTuauebemJXmos_mLMTyLhEHL-p5Wv6J88WkgzyjAt_DW7laiPMYw2sqRXkOiMJLwhifRzbSp8ZgJBM25IX05dKKSS4XfFjJQQjOBHw6PYtEF5pUDMLHML3jcddCrX07abfef_DuP41PqOQYsjwesLZ8XsRj-R0TH4diOZ_GQop8_oawjRIo9eJr9Wbtho0h8kAzHYpfuhamOPT718EaGAY6SSrR7t6nBkzGNkrKAmHkC7aRwe.AbZG53wRqgF0XRG3wUK_UQ",

"Eci": 0

},

"SoftDescriptor": "123456789ABCD",

"Amount": 100,

"ReceivedDate": "2018-03-19 16:08:16",

"Status": 1,

"IsSplitted": false,

"ReturnMessage": "Operation Successful",

"ReturnCode": "4",

"PaymentId": "e57b09eb-475b-44b6-ac71-01b9b82f2491",

"Type":"CreditCard",

"Currency":"BRL",

"Country":"BRA",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491"

},

{

"Method": "PUT",

"Rel": "capture",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/capture"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/e57b09eb-475b-44b6-ac71-01b9b82f2491/void"

}

]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

ProofOfSale |

Authorization number, identical to the NSU. | Text | 6 | Alphanumeric |

Tid |

Transaction ID on the acquirer. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code. | Text | 6 | Alphanumeric |

SoftDescriptor |

Text to be printed on the bearer’s bank statement. Note: Does not allow special characters. Available for VISA/MASTER only. | Text | 13 | Alphanumeric |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ECI |

Electronic Commerce Indicator. Represents how secure a transaction is. | Text | 2 | Examples: 7 |

Status |

Transaction status. | Byte | 2 | E.g.: 1 |

ReturnCode |

Return code from the acquirer. | Text | 32 | Alphanumeric |

ReturnMessage |

Return message from acquirer. | Text | 512 | Alphanumeric |

Type |

Wallet type: “ApplePay” / “SamsungPay” / “GooglePay”. | Text | 255 | Alphanumeric |

WalletKey |

Cryptographic key that identifies stores in wallets. Check the WalletKey table in the ANNEXES for more information. | Text | 255 | See “WalletKey” table |

List of statuses returned by the API:

| Code | Payment status | Payment method | Description |

|---|---|---|---|

| 0 | NotFinished | All | Failed to process the payment. Possible causes: incorrect data, error in the request, acquirer timeout, some processing instability. In case of debit transaction, the buyer may have abandoned the purchase. |

| 1 | Authorized | All | Payment methods able to be captured or paid (boleto). For a boleto transaction, it means that the boleto was successfully generated. For a card transaction, it means that there was approval by the issuing bank. However, this does not mean that the transaction has been completed - for this, a second step is required, capturing the transaction or making the payment. |

| 2 | PaymentConfirmed | All | Payment confirmed and completed. |

| 3 | Denied | Credit and debit cards (electronic transfer) and e-wallets. | Payment denied by authorizer. Possible causes: insufficient limit, lack of payment on the card, unavailable brand, blocking due to fraud, among others. To find out the real reason for the denial, it is necessary to look at the return code generated during the transaction. |

| 10 | Voided | All, except boleto | Payment canceled. It is the suspension of the transaction, exempting from fees or amounts charged. Pre-authorized transactions can be canceled even after 23:59 on the authorization date. Captured transactions can be canceled up to 11:59 pm on the same day of authorization, after which time the amount will be reversed. |

| 11 | Refunded | Credit and debit cards and e-wallets. | Payment cancelled/reversed. Means that the cancellation of the transaction was requested, which may occur from 0:00 am on the day after the creation of the transaction. Regardless of the amount, it is only possible to make one reversal request per transaction. This can happen due to incorrect data or at the request of the shopper. |

| 12 | Pending | Credit and debit cards (electronic transfer), e-wallets and pix. | Awaiting return from financial institution. Means that the transaction was sent to Cielo in the pre-authorization process, awaiting a response from the issuing bank to validate it. |

| 13 | Aborted | All | Payment canceled due to processing failure. Means that the transaction was canceled due to processing failure. It can also be aborted if Anti-Fraud denies the transaction before authorization. |

| 20 | Scheduled | Credit card and e-wallets. | Scheduled recurrence. Means that the transaction will have a scheduled recurrence, that is, the purchase amount will be collected on the day it was scheduled by the store. |