The purpose of this documentation is to guide the developer on how to integrate with the Pagador API, Braspag’s payment gateway, describing all available services using request and response examples.

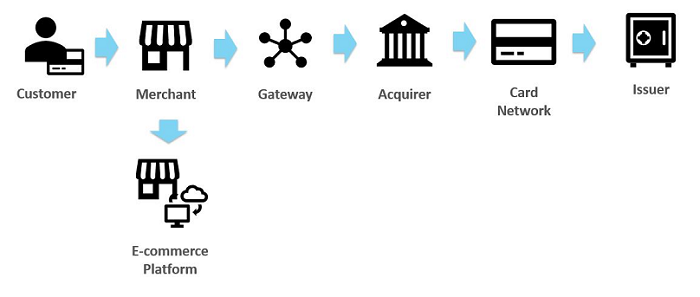

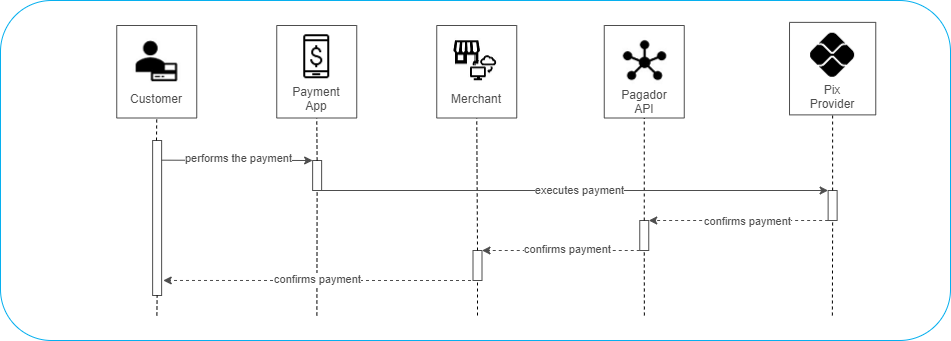

Below is the representation of a standard transactional flow, followed by a short description of the main parties involved:

The Pagador API solution (refer to this article in Portuguese for more details) was developed with the market reference REST technology, which works regardless of the technology used by our customers. Therefore, it is possible to integrate using various programming languages, such as: ASP, ASP.Net, Java, PHP, Ruby and Python.

Here are some of the main benefits of using Braspag’s e-commerce platform:

The model used in the integration of the APIs is simple. It is based in the use of two URLs:

To perform an operation:

| HTTP Method | Description |

|---|---|

| GET | Retrieves existing resources, e.g.: a transaction query. |

| POST | Creates new resources, e.g.: creating a transaction. |

| PUT | Updates existing resources, e.g.: capturing or canceling a previously authorized transaction. |

All operations require the access credentials “Merchant ID” and “Merchant Key” to be sent through the request header.

Each request operation will return an HTTP Status code, indicating whether it was successfully completed or not.

Use our Sandbox environment to test our products and services before bringing your solution into the Production environment.

Create an account in our sandbox and try out our APIs during your testing phase, with no commitment.

| Information | Description |

|---|---|

| Access credentials | MerchantId and MerchantKey received after your test account creation in Sandbox Registration. |

| Base URL for transactions | https://apisandbox.braspag.com.br/ |

| Base URL for query services | https://apiquerysandbox.braspag.com.br/ |

Once you are done running your tests and ready for go-live, you can implement your solution in the production environment.

| Information | Description |

|---|---|

| Access credentials | MerchantId and MerchantKey provided by Braspag. If you need more information, please contact Braspag Suppport Service. |

| Base URL for transactions | https://api.braspag.com.br/ |

| Base URL for query services | https://apiquery.braspag.com.br/ |

In order for you to better enjoy the features available in our API, it is important to first understand some of the concepts involved in the process of a credit card transaction:

| Step | Description |

|---|---|

| Authorization | Makes the process of a credit card sale possible. The authorization (also called pre-authorization) only earmarks the customer’s fund, not yet releasing it from their account. |

| Capture | Moves the transaction out of the pending state, so that the charging can take effect. The time limit for capturing a pre-authorized transaction varies between acquirers, reaching up to 5 days after the pre-authorization date. |

| Automatic Capture | Authorizes and captures the transaction at the same time, exempting the merchant from sending a confirmation. |

| Cancellation | Cancels the sale on the same day of its authorization/capture. In case of an authorized transaction, the cancellation will release the limit of the card that has been earmarked. If the transaction has already been captured, the cancellation will undo the sale, but only if executed on the same day. |

| Refund | Cancels de sale on the day after its capture. The transaction will be submitted to the chargeback process by the acquirer. |

Some of the important features that we offer for your transactions are listed below:

| Term | Description |

|---|---|

| Antifraude | A feature which consists in a fraud prevention platform, that provides a detailed risk analysis of online purchases. The process is fully transparent to the cardholder. According to a pre-established criteria, the request can be automatically accepted, rejected or redirected for manual review. For further information, refer to the Antifraude integration guide. |

| Autenticação | A process which allows the transaction to pass through the card issuing bank authentication process, bringing more security to the sale as it transfers the risk of fraud to the issuer. For further information, refer to the 3DS 2.0 Authentication documentation. |

| Cartão Protegido | A platform that offers secure storage of sensitive credit card data. This data is transformed into an encrypted code called “token”, which can be stored in a database. With this platform, the store is able to offer features such as “1-Click Purchase” and “Transaction Submission Retry”, while preserving the integrity and confidentiality of that data. For further information, refer to the Cartão Protegido integration guide. |

You can access our web support tool here: Zendesk and check our Atendimento Braspag article, in Portuguese, for further information about our support service.

The Pagador API works with transactions made with the following payment methods: credit card, debit card, boleto bill, electronic transfer, e-wallet and voucher.

To prevent duplicate orders from occurring during a transaction, Pagador has the option of blocking duplicate orders which, when enabled, returns the “302” error code, informing that the MerchantOrderId sent is duplicated. For more details on the feature, you can refer to this article, in Portuguese.

When requesting authorization for a credit transaction, it is necessary to follow the contract below. The details related to your affiliation are sent within the Payment.Credentials node, and must be sent whenever a new authorization request is submitted for approval.

If your store uses Retry or Loadbalance services, affiliations must be registered by the customer support team. To request the registration of affiliations, click here and send your request.

The parameters contained within the Address and DeliveryAddress nodes are required when the transaction is submitted to the Antifraude or Velocity analysis. These parameters are marked with an * in the required column of the table below.

Mastercard and Hipercard credit card transactions with stored credentials: Mastercard and Hipercard brands require the Transaction Initiator Indicator for credit and debit card transactions using stored card data. The goal is to indicate if the transaction was initiated by the cardholder or by the merchant. In this scenario, the node

InitiatedTransactionIndicatormust be sent with the parametersCategoryandSubCategoryfor Mastercard and Hipercard transactions, within thePaymentnode. Please check the complete list of categories in theCategoryparameter description and the subcategories tables in Transaction Initiator Indicator.

Here are request and response examples on how to create a credit transaction:

{

"MerchantOrderId":"2017051002",

"Customer":{

"Name":"Shopper Name",

"Identity":"12345678909",

"IdentityType":"CPF",

"Email": "shopper@braspag.com.br",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment":{

"Provider":"Simulado",

"Type":"CreditCard",

"Amount":10000,

"Currency":"BRL",

"Country":"BRA",

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"SoftDescriptor":"Message",

"DoSplit":false,

"Tip":false,

"CreditCard":{

"CardNumber":"4551870000000181",

"Holder": "Cardholder Name",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false",

"Alias":"",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"Credentials":{

"code":"9999999",

"key":"D8888888",

"password":"LOJA9999999",

"username":"#Braspag2018@NOMEDALOJA#",

"signature":"001"

},

"ExtraDataCollection":[

{

"Name":"FieldName",

"Value":"FieldValue"

}

]

}

}

--request POST "https://apisandbox.braspag.com.br/v2/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2017051002",

"Customer":{

"Name": "shopper Name",

"Identity": "12345678909",

"IdentityType": "CPF",

"Email": "shopper@braspag.com.br",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment":{

"Provider":"Simulado",

"Type":"CreditCard",

"Amount":10000,

"Currency":"BRL",

"Country":"BRA",

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"SoftDescriptor":"Message",

"DoSplit":false,

"Tip":false,

"CreditCard":{

"CardNumber":"455187******0181",

"Holder": "Cardholder Name",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false",

"Alias":"",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"Credentials":{

"Code":"9999999",

"Key":"D8888888",

"Password":"LOJA9999999",

"Username":"#Braspag2018@NOMEDALOJA#",

"Signature":"001"

},

"ExtraDataCollection":[

{

"Name":"FieldName",

"Value":"FieldValue"

}

]

}

}

--verbose

If your transaction is undergoing fraud analysis, the property sizes may differ. Please refer to Payments with Fraud Analysis.

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

MerchantId |

Store identifier at Braspag. | GUID | 36 | Yes (through header) |

MerchantKey |

Public key for dual authentication at Braspag. | Text | 40 | Yes (through header) |

RequestId |

Store-defined request identifier used when the merchant uses different servers for each GET/POST/PUT. | GUID | 36 | No (through header) |

MerchantOrderId |

Order ID number. | Text | 50 | Yes |

Customer.Name |

Customer’s name. | Text | 255 | Yes |

Customer.Identity |

Customer’s ID number. | Text | 14 | No |

Customer.IdentityType |

Customer’s ID document type (CPF or CNPJ). | Text | 255 | No |

Customer.Email |

Customer’s email address. | Text | 255 | No |

Customer.Birthdate |

Customer’s date of birth in the YYYY-MM-DD format. | Date | 10 | No |

Customer.IpAddress |

Customer’s IP address. IPv4 and IPv6 support. | Text | 45 | No |

Customer.Address.Street |

Customer’s address street. | Text | 255 | No* |

Customer.Address.Number |

Customer’s contact address number. | Text | 15 | No* |

Customer.Address.Complement |

Customer’s contact address additional information. | Text | 50 | No* |

Customer.Address.ZipCode |

Customer’s contact address zip code. | Text | 9 | No* |

Customer.Address.City |

Customer’s contact address city. | Text | 50 | No* |

Customer.Address.State |

Customer’s contact address state. | Text | 2 | No* |

Customer.Address.Country |

Customer’s contact address country. | Text | 35 | No* |

Customer.Address.District |

Customer’s neighborhood. | Text | 50 | No* |

Customer.DeliveryAddress.Street |

Delivery address street. | Text | 255 | No* |

Customer.DeliveryAddress.Number |

Delivery address number. | Text | 15 | No* |

Customer.DeliveryAddress.Complement |

Delivery address additional information. | Text | 50 | No* |

Customer.DeliveryAddress.ZipCode |

Delivery address zip code. | Text | 9 | No* |

Customer.DeliveryAddress.City |

Delivery address city. | Text | 50 | No* |

Customer.DeliveryAddress.State |

Delivery address state. | Text | 2 | No* |

Customer.DeliveryAddress.Country |

Delivery address country. | Text | 35 | No* |

Customer.DeliveryAddress.District |

Delivery address neighborhood. | Text | 50 | No* |

Payment.Provider |

Name of payment method provider. | Text | 15 | Yes |

Payment.Type |

Payment method type. | Text | 100 | Yes |

Payment.Amount |

Order amount in cents. | Number | 15 | Yes |

Payment.ServiceTaxAmount |

Applicable for airlines only. Value of the amount of the authorization to be allocated to the service charge. Note: This value is not added to the authorization value. | Number | 15 | No |

Payment.Currency |

Currency in which the payment will be made (BRL / USD / MXN / COP / CLP / ARS / PEN / EUR / PYN / UYU / VEB / VEF / GBP). | Text | 3 | No |

Payment.Country |

Country in which the payment will be made. | Text | 3 | No |

Payment.Installments |

Number of installments. | Number | 2 | Yes |

Payment.Interest |

Installment type - Store (“ByMerchant”) or Issuer (“ByIssuer”). | Text | 10 | No |

Payment.Capture |

Indicates whether the authorization will use automatic capture (“true”) or not (“false”). Please check with acquirer about the availability of this feature. | Boolean | — | No (default “false”) |

Payment.Authenticate |

Indicates whether the transaction will be authenticated (“true”) or not (“false”). Please check with acquirer about the availability of this feature. | Boolean | — | No (default “false”) |

Payment.Recurrent |

Indicates whether the transaction is of recurring type (“true”) or not (“false”). The “true” value will not set a new recurrence, it will only allow the execution of a transaction without the need to send CVV. Authenticate must be “false” when Recurrent is “true”. For Cielo, Cielo 30 and Rede2 transactions only. |

Boolean | — | No (default “false”) |

Payment.SoftDescriptor |

Text to be printed on bearer’s invoice. | Text | 13 | No |

Payment.DoSplit |

Indicates whether the transaction will be split between multiple accounts (“true”) or not (“false”). | Boolean | — | No (default “false”) |

Payment.Tip |

Tipping is a type of transaction available for credit or debit card, tokenized or not. If “true”, the transaction is identified as a tip, otherwise send Tip as “false”. | Boolean | — | No (default “false”) |

Payment.ExtraDataCollection.Name |

Name of the extra data field. | Text | 50 | No |

Payment.ExtraDataCollection.Value |

Value of the extra data field. | Text | 1024 | No |

Payment.Credentials.Code |

Affiliation generated by acquirer. | Text | 100 | Yes |

Payment.Credentials.Key |

Affiliation key/token generated by acquirer. | Text | 100 | Yes |

Payment.Credentials.Username |

Username generated on credential process with the Getnet acquirer (field must be submitted if transaction is directed to Getnet). | Text | 50 | No |

Payment.Credentials.Password |

Password generated on credential process with the Getnet acquirer (field must be submitted if transaction is directed to Getnet). | Text | 50 | No |

Payment.Credentials.Signature |

Submission of the TerminalID for Global Payments (applicable to merchants affiliated with this acquirer). E.g.: “001”. For Safra, send establishment name, city and state concatenated with a semicolon (;), e.g.: “EstablishmentName;SaoPaulo;SP”. | Text | 3 | No |

Payment.PaymentFacilitator.EstablishmentCode |

Facilitator establishment code. “Facilitator ID” (Facilitator register with card network). Applicable to Provider Cielo30 or Rede2. |

Number | 11 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.EstablishmentCode |

Sub-merchant’s establishment code. “Sub-Merchant ID” (Sub-accredited register with facilitator). Applicable to Provider Cielo30 or Rede2. |

Number | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.Mcc |

Sub-merchant’s MCC. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Number | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.Address |

Sub-merchant’s address. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.City |

Sub-merchant’s city. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.State |

Sub-merchant’s state. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.PostalCode |

Sub-merchant’s postal code. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.PhoneNumber |

Sub-merchant’s telephone number. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.Identity |

Sub-merchant’s CNPJ or CPF. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.CountryCode |

Sub-merchant’s country code based on ISO 3166. Applicable to Provider Cielo30, Rede2 or PagSeguro. |

Text | 15 | Yes for facilitators |

Payment.PaymentFacilitator.SubEstablishment.CompanyName |

Sub-merchant’s Company Name. | text* | 60 | Only for PagSeguro |

Payment.PaymentFacilitator.SubEstablishment.AddressNumber |

Sub-merchant’s address number. | text* | 60 | Only for PagSeguro |

Payment.PaymentFacilitator.SubEstablishment.District |

Sub-merchant’s neighborhood. | text* | 60 | Only for PagSeguro |

Payment.CreditCard.CardNumber |

Customer’s card number. | Text | 19 | Yes |

Payment.CreditCard.Holder |

Name of cardholder printed on the card. | Text | 25 | Yes |

Payment.CreditCard.ExpirationDate |

Expiration date printed on the card. | Text | 7 | Yes |

Payment.CreditCard.SecurityCode |

Security code printed on the back of the card. | Text | 4 | Yes |

Payment.CreditCard.Brand |

Card brand. | Text | 10 | Yes |

Payment.CreditCard.SaveCard |

Indicates whether the card will be saved to generate the token (CardToken). | Boolean | — | No (default “false”) |

Payment.CreditCard.Alias |

Name given by merchant to card saved as CardToken. | Text | 64 | No |

Payment.CreditCard.CardOnFile.Usage |

“First” if the card has been stored and it is your first use. “Used” if the card has been stored and it has been used previously in another transaction. Applicable to Provider Cielo only. |

Text | - | No |

Payment.CreditCard.CardOnFile.Reason |

Indicates the purpose of the card storage, in case the Usage field is “Used”.“Recurring” - Scheduled recurring purchase (e.g.: subscription services). “Unscheduled” - Unscheduled recurring purchase (e.g.: services apps). “Installments” - Installment through recurrence. Applicable to Provider Cielo only. |

Text | - | Conditional |

{

"MerchantOrderId":"2017051002",

"Customer":{

"Name":"Shopper Name",

"Identity":"12345678909",

"IdentityType":"CPF",

"Email": "shopper@braspag.com.br",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"DoSplit":false,

"Tip":false,

"CreditCard":{

"CardNumber": "455187******0181",

"Holder": "Cardholder Name",

"ExpirationDate":"12/2021",

"SaveCard":"false",

"Brand":"Visa",

"Alias": "",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"Credentials":{

"Code":"9999999",

"Key":"D8888888",

"Password":"LOJA9999999",

"Username":"#Braspag2018@NOMEDALOJA#"

},

"ProofOfSale": "20170510053219433",

"AcquirerTransactionId": "0510053219433",

"AuthorizationCode": "936403",

"SoftDescriptor":"Message",

"VelocityAnalysis": {

"Id": "c374099e-c474-4916-9f5c-f2598fec2925",

"ResultMessage": "Accept",

"Score": 0

},

"PaymentId": "c374099e-c474-4916-9f5c-f2598fec2925",

"Type":"CreditCard",

"Amount":10000,

"ReceivedDate": "2017-05-10 17:32:19",

"CapturedAmount": 10000,

"CapturedDate": "2017-05-10 17:32:19",

"Currency":"BRL",

"Country":"BRA",

"Provider":"Simulado",

"ExtraDataCollection": [{

"Name":"FieldName",

"Value":"FieldValue"

}],

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

"Links": [{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925/void"

}

]

}

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2017051002",

"Customer":{

"Name":"Shopper Name",

"Identity":"12345678909",

"IdentityType":"CPF",

"Email": "shopper@braspag.com.br",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27th floor",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"DoSplit":false,

"Tip":false,

"CreditCard":{

"CardNumber": "455187******0181",

"Holder": "Cardholder Name",

"ExpirationDate":"12/2021",

"SaveCard":"false",

"Brand":"Visa",

"Alias": "",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"Credentials":{

"code":"9999999",

"key":"D8888888",

"password":"LOJA9999999",

"username":"#Braspag2018@NOMEDALOJA#"

},

"ProofOfSale": "20170510053219433",

"AcquirerTransactionId": "0510053219433",

"AuthorizationCode": "936403",

"SoftDescriptor":"Message",

"VelocityAnalysis": {

"Id": "c374099e-c474-4916-9f5c-f2598fec2925",

"ResultMessage": "Accept",

"Score": 0

},

"PaymentId": "c374099e-c474-4916-9f5c-f2598fec2925",

"Type":"CreditCard",

"Amount":10000,

"ReceivedDate": "2017-05-10 17:32:19",

"CapturedAmount": 10000,

"CapturedDate": "2017-05-10 17:32:19",

"Currency":"BRL",

"Country":"BRA",

"Provider":"Simulado",

"ExtraDataCollection": [{

"Name":"FieldName",

"Value":"FieldValue"

}],

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

"Links": [{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925/void"

}

]

}

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AcquirerTransactionId |

Transaction ID at payment provider. | Text | 40 | Alphanumeric |

ProofOfSale |

Proof of sale reference. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code from the acquirer. | Text | 300 | Alphanumeric text |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReceivedDate |

Date the transaction was received by Braspag. | Text | 19 | YYYY-MM-DD HH:mm:SS |

CapturedDate |

Date the transaction was captured. | Text | 19 | YYYY-MM-DD HH:mm:SS |

CapturedAmount |

Captured amount in cents. | Number | 15 | 100 equivalent to R$ 1,00 |

ECI |

Electronic Commerce Indicator. Represents the authentication result. | Text | 2 | E.g.: 5 |

ReasonCode |

Return code from operation. | Text | 32 | Alphanumeric |

ReasonMessage |

Return message from operation. | Text | 512 | Alphanumeric |

Status |

Transaction status. See our Transaction Status table. | Byte | 2 | E.g.: 1 |

ProviderReturnCode |

Code returned by the payment provider (acquirer or issuer). | Text | 32 | 57 |

ProviderReturnMessage |

Message returned by the payment provider (acquirer or issuer). | Text | 512 | Transaction Approved |

A debit card transaction is carried out in the same way as a credit card transaction. It is mandatory, however, to submit it to the authentication process.

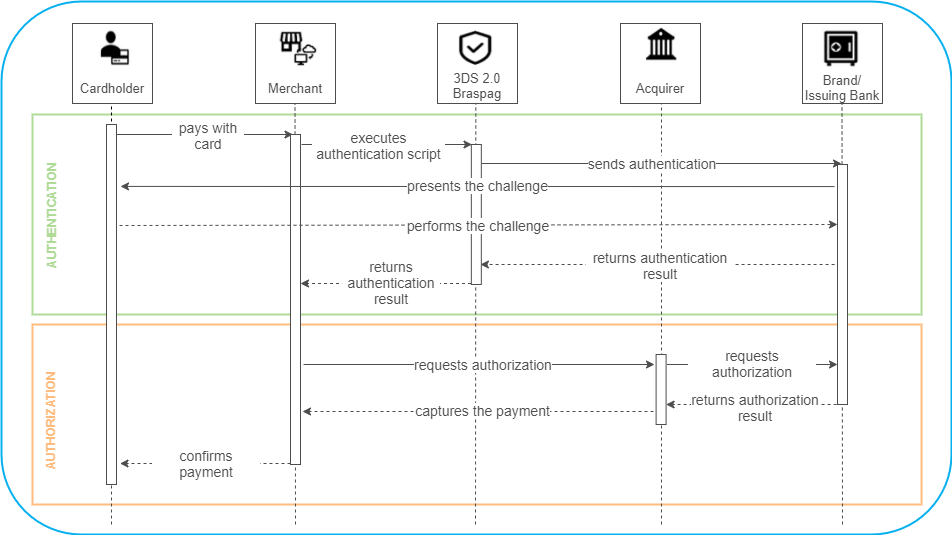

All debit transactions must be authenticated as required by the issuing banks and brands, in order to promote greater security. To authenticate a debit transaction, we use the EMV 3DS 2.0 protocol. This protocol is a script integrated into the e-commerce website that verifies the identity of the cardholder while maintaining a good shopping experience and reducing the risk of fraud.

To integrate the authentication method, check the 3DS 2.0 documentation.

See below the representation of a standard transactional flow in the creation of a debit transaction, with the authentication and authorization steps:

Mastercard and Hipercard debit card transactions with stored credentials: Mastercard and Hipercard brand requires the Transaction Initiator Indicator for credit and debit card transactions using stored card data. The goal is to indicate whether the transaction was initiated by the cardholder or by the merchant. In this scenario, the node

InitiatedTransactionIndicatormust be sent with the parametersCategoryandSubCategoryfor Mastercard and Hipercard transactions, within thePaymentnode. Please check the complete list of categories in theCategoryparameter description and the subcategories tables in Transaction Initiator Indicator.

{

"MerchantOrderId":"202301131052",

"Customer":{

"Name":"Nome do Comprador",

"Identity":"12345678900",

"IdentityType":"CPF",

"Email":"comprador@email.com.br",

"Birthdate":"1991-01-02",

"IpAddress":"127.0.0.1",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment":{

"DebitCard":{

"CardNumber":"************1106",

"Holder":"NOME DO TITULAR DO CARTÃO",

"ExpirationDate":"12/2030",

"SaveCard":false,

"Brand":"Master" },

"Authenticate":true,

"Recurrent":false,

"ReturnUrl":"https://braspag.com.br",

"ProofOfSale":"20230113",

"AcquirerTransactionId":"0510053219433",

"AuthorizationCode":"936403",

"Tip":false,

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"5",

"Version":"2",

"ReferenceId":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6" },

"ExtraDataCollection":[

{

"Name":"NomeDoCampo",

"Value":"ValorDoCampo"

}

]},

"InitiatedTransactionIndicator":{

"Category": "C1",

"Subcategory": "Standingorder"

}

}

--request POST "https://apisandbox.braspag.com.br/v2/sales"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--header "MerchantKey: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--data-binary

--verbose

{

"MerchantOrderId":"202301131052",

"Customer":{

"Name":"Nome do Comprador",

"Identity":"12345678900",

"IdentityType":"CPF",

"Email":"comprador@email.com.br",

"Birthdate":"1991-01-02",

"IpAddress":"127.0.0.1",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment":{

"DebitCard":{

"CardNumber":"************1106",

"Holder":"NOME DO TITULAR DO CARTÃO",

"ExpirationDate":"12/2030",

"SaveCard":false,

"Brand":"Master" },

"Authenticate":true,

"Recurrent":false,

"ReturnUrl":"https://braspag.com.br",

"ProofOfSale":"20230113",

"AcquirerTransactionId":"0510053219433",

"AuthorizationCode":"936403",

"Tip":false,

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"5",

"Version":"2",

"ReferenceId":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6" },

"ExtraDataCollection":[

{

"Name":"NomeDoCampo",

"Value":"ValorDoCampo"

}

]},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

}

}

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

Payment.Provider |

Name of payment method provider. | Text | 15 | Yes |

Payment.Type |

Payment method type. In this case, “DebitCard”. | Text | 100 | Yes |

Payment.Amount |

Order amount in cents. | Number | 15 | Yes |

Payment.Installments |

Number of installments. | Number | 2 | Yes |

Payment.ReturnUrl |

URL to which the user will be redirected at the end of the payment. | Text | 1024 | Yes |

Payment.Tip |

Tipping is a type of transaction available for credit or debit card, tokenized or not. If “true”, the transaction is identified as a tip, otherwise send Tip as “false”. | Boolean | — | No (default “false”) |

Payment.DebitCard.CardNumber |

Customer’s card number. | Text | 16 | Yes |

Payment.DebitCard.Holder |

Name of the cardholder printed on the card. | Text | 25 | Yes |

Payment.DebitCard.ExpirationDate |

Expiration date printed on the card, in the MM/YYYY format. | Text | 7 | Yes |

Payment.DebitCard.SecurityCode |

Security code printed on the back of the card. | Text | 4 | Yes |

Payment.DebitCard.Brand |

Card brand. | Text | 10 | Yes |

Payment.DebitCard.CardOnFile.Usage |

“First” if the card has been stored and it is your first use. “Used” if the card has been stored and it has been used previously in another transaction. Applicable to Provider Cielo only. |

Text | - | No |

Payment.DebitCard.CardOnFile.Reason |

Indicates the purpose of the card storage, in case the Usage field is “Used”.“Recurring” - Scheduled recurring purchase (e.g.: subscription services). “Unscheduled” - Unscheduled recurring purchase (e.g.: services apps). “Installments” - Installment through recurrence. Applicable to Provider Cielo only. |

Text | - | Conditional |

Payment.Authenticate |

Defines whether the buyer will be directed to the issuer for card authentication. | Boolean (“true” / “false”) | - | Yes, if the authentication is validated. |

Payment.ExternalAuthentication.ReturnUrl |

Callback URL only applicable if version is “1”. | Alphanumeric | 1024 | Yes. |

Payment.ExternalAuthentication.Cavv |

Signature returned in authentication success scenarios. | Text | 28 | Yes, if authentication is validated. |

Payment.ExternalAuthentication.Xid |

XID returned in the authentication process. | Text | 28 | Yes, when the 3DS version is “1”. |

Payment.ExternalAuthentication.Eci |

Electronic Commerce Indicator returned in the authentication process. | Number | 1 | Yes. |

Payment.ExternalAuthentication.Version |

3DS version used in the authentication process. | Alphanumeric | 1 position | Yes, when the 3DS version is “2”. |

Payment.ExternalAuthentication.ReferenceId |

RequestID returned in the authentication process. | GUID | 36 | Yes, when the 3DS version is “2”. |

Payment.InitiatedTransactionIndicator.Category |

Transaction Initiator Indicator category. Valid for brands Mastercard and Hipercard. Possible values: - “C1”: transaction initiated by the cardholder; - “M1”: recurring payment or installment initiated by the merchant - “M2”: transaction initiated by the merchant. |

string | 2 | Conditional. Required for Mastercard and Hipercard. |

Payment.InitiatedTransactionIndicator.Subcategory |

Indicator subcategory. Valid for brands Mastercard and Hipercard. Possible values: If InitiatedTransactionIndicator.Category = “C1” or “M1”CredentialsOnFile StandingOrder Subscription Installment If InitiatedTransactionIndicator.Category = “M2”PartialShipment RelatedOrDelayedCharge NoShow Resubmission Please refer to Transaction Initiator Indicator tables for the full list. |

string | - | Conditional. Required for Mastercard and Hipercard. |

{

"MerchantOrderId": "2017051002",

"Customer": {

"Name": "Nome do Comprador",

"Identity": "12345678909",

"IdentityType": "CPF",

"Email": "comprador@braspag.com.br",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Alameda Xingu",

"Number": "512",

"Complement": "27 andar",

"ZipCode": "12345987",

"City": "São Paulo",

"State": "SP",

"Country": "BRA",

"District": "Alphaville"

},

"DeliveryAddress": {

"Street": "Alameda Xingu",

"Number": "512",

"Complement": "27 andar",

"ZipCode": "12345987",

"City": "São Paulo",

"State": "SP",

"Country": "BRA",

"District": "Alphaville"

},

"Payment": {

"DebitCard": {

"CardNumber": "455187******0181",

"Holder": "NOME DO TITULAR DO CARTÃO",

"ExpirationDate": "12/2031",

"SaveCard": false,

"Brand": "Visa" },

"Authenticate":true,

"Recurrent":false,

"ReturnUrl":"http://www.braspag.com.br",

"ProofOfSale":"20230115053219433",

"AcquirerTransactionId":"10069930690009D366FA",

"AuthorizationCode":"936403",

"Tip":false,

"SentOrderId":"10045146",

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"02",

"Version":"2",

"ReferenceId":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6" },

"PaymentId":"21423fa4-6bcf-448a-97e0-e683fa2581b",

"Type":"DebitCard",

"Amount":10000,

"ReceivedDate":"2023-01-09 16:24:14",

"CapturedAmount":10000,

"CapturedDate":"2023-01-09 16:24:15",

"Currency":"BRL",

"Country":"BRA",

"Provider":"Cielo",

"ExtraDataCollection":[

{

"Name":"NomeDoCampo",

"Value":"ValorDoCampo" }

],

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"ReasonCode":0,

"ReasonMessage":"Successful",

"Status":2,

"ProviderReturnCode":"00",

"ProviderReturnMessage":"Successful",

"Links":[

{

"Method":"GET",

"Rel":"self",

"Href":"https://apiquerysandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925" },

{

"Method":"PUT",

"Rel":"void",

"Href":"https://apisandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925/void" }

]

}

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId": "2017051002",

"Customer": {

"Name": "Nome do Comprador",

"Identity": "12345678909",

"IdentityType": "CPF",

"Email": "comprador@braspag.com.br",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Alameda Xingu",

"Number": "512",

"Complement": "27 andar",

"ZipCode": "12345987",

"City": "São Paulo",

"State": "SP",

"Country": "BRA",

"District": "Alphaville"

},

"DeliveryAddress": {

"Street": "Alameda Xingu",

"Number": "512",

"Complement": "27 andar",

"ZipCode": "12345987",

"City": "São Paulo",

"State": "SP",

"Country": "BRA",

"District": "Alphaville"

},

"Payment": {

"DebitCard": {

"CardNumber": "455187******0181",

"Holder": "NOME DO TITULAR DO CARTÃO",

"ExpirationDate": "12/2031",

"SaveCard": false,

"Brand": "Visa" },

"Authenticate":true,

"Recurrent":false,

"ReturnUrl":"http://www.braspag.com.br",

"ProofOfSale":"20230115053219433",

"AcquirerTransactionId":"10069930690009D366FA",

"AuthorizationCode":"936403",

"Tip":false,

"SentOrderId":"10045146",

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"02",

"Version":"2",

"ReferenceId":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6" },

"PaymentId":"21423fa4-6bcf-448a-97e0-e683fa2581b",

"Type":"DebitCard",

"Amount":10000,

"ReceivedDate":"2023-01-09 16:24:14",

"CapturedAmount":10000,

"CapturedDate":"2023-01-09 16:24:15",

"Currency":"BRL",

"Country":"BRA",

"Provider":"Cielo",

"ExtraDataCollection":[

{

"Name":"NomeDoCampo",

"Value":"ValorDoCampo" }

],

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"ReasonCode":0,

"ReasonMessage":"Successful",

"Status":2,

"ProviderReturnCode":"00",

"ProviderReturnMessage":"Successful",

"Links":[

{

"Method":"GET",

"Rel":"self",

"Href":"https://apiquerysandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925" },

{

"Method":"PUT",

"Rel":"void",

"Href":"https://apisandbox.braspag.com.br/v2/sales/c374099e-c474-4916-9f5c-f2598fec2925/void" }

]

}

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AcquirerTransactionId |

Transaction ID of the payment method provider. | Text | 40 | Alphanumeric |

ProofOfSale |

Proof of sale reference. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code from the acquirer. | Text | 300 | Alphanumeric text |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReceivedDate |

Date the transaction was received by Braspag. | Text | 19 | YYYY-MM-DD HH:mm:SS |

ReasonCode |

Operation return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Operation return message. | Text | 512 | Alphanumeric |

Status |

Transaction Status. | Byte | 2 | E.g.: 1 |

ProviderReturnCode |

Code returned by the payment provider (acquirer or issuer). | Text | 32 | 57 |

ProviderReturnMessage |

Message returned by the payment provider (acquirer or issuer). | Text | 512 | Transaction Approved |

Payment.MerchantAdviceCode |

Flag return code that defines period for retry. Valid for brands Mastercard and Hipercard. | Text | 2 | Numeric |

Payment.ExternalAuthentication.Cavv |

Cavv value submitted in the authorization request. | Text | 28 | kBMaEAEAbV3FcwnExrXh4phhmpIj |

Payment.ExternalAuthentication.Xid |

Xid value submitted in the authorization request. | Text | 28 | ZGUzNzgwYzQxM2ZlMWMxMzVkMjc= |

Payment.ExternalAuthentication.Eci |

ECI value submitted in the authorization request. | Number | 1 | Ex. 5 |

Payment.ExternalAuthentication.Version |

3DS version used in the authentication process. | Alphanumeric | 1 | Ex: 2 |

Payment.ExternalAuthentication.ReferenceId |

RequestID returned in the authentication process. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

It is possible to process a debit card without having to submit your customer to the authentication process. You will find more details in the Débito sem Senha article, written in Portuguese.

That is the case with the “Coronavoucher” emergency aid, provided by the government, which can be consumed through the Caixa Econômica Federal virtual debit card. In such case, the request must follow the Debit Card pattern, only with no authentication, according to the example below.

{

"MerchantOrderId":"2017051001",

"Customer":{

"Name":"Nome do Comprador",

"Identity":"12345678909",

"IdentityType":"CPF",

"Email":"comprador@braspag.com.br",

"Birthdate":"1991-01-02",

"IpAddress":"127.0.0.1",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment": {

"Provider": "Cielo30",

"Type": "DebitCard",

"Amount": 10000,

"Currency": "BRL",

"Country": "BRA",

"Installments": 1,

"Capture": true,

"Authenticate": false,

"DebitCard":{

"CardNumber":"5067220000000001",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Elo"

"CardOnFile":{

"Usage":"Used",

"Reason":"Unscheduled"

},

[...]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2017051001",

"Customer":{

"Name":"Nome do Comprador",

"Identity":"12345678909",

"IdentityType":"CPF",

"Email":"comprador@braspag.com.br",

"Birthdate":"1991-01-02",

"IpAddress":"127.0.0.1",

"Address":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

},

"DeliveryAddress":{

"Street":"Alameda Xingu",

"Number":"512",

"Complement":"27 andar",

"ZipCode":"12345987",

"City":"São Paulo",

"State":"SP",

"Country":"BRA",

"District":"Alphaville"

}

},

"Payment": {

"Provider": "Cielo30",

"Type": "DebitCard",

"Amount": 10000,

"Currency": "BRL",

"Country": "BRA",

"Installments": 1,

"Capture": true,

"Authenticate": false,

"DebitCard":{

"CardNumber":"5067220000000001",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Elo"

"CardOnFile":{

"Usage":"Used",

"Reason":"Unscheduled"

},

[...]

}

}

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

Payment.Provider |

Name of payment method provider. Applicable to “Cielo30” only. | Text | 15 | Yes |

Payment.Type |

Payment method type. In this case, “DebitCard”. | Text | 100 | Yes |

Payment.Amount |

Order amount in cents. | Number | 15 | Yes |

Payment.Installments |

Number of installments. For this type, always use “1”. | Number | 2 | Yes |

DeditCard.CardNumber |

Customer’s card number. | Text | 16 | Yes |

DeditCard.Holder |

Name of cardholder printed on the card. | Text | 25 | Yes |

DebitCard.ExpirationDate |

Expiration date printed on the card, in the MM/YYYY format. | Text | 7 | Yes |

DebitCard.SecurityCode |

Security code printed on the back of the card. | Text | 4 | Yes |

DebitCard.Brand |

Card brand. For this type, always use “Elo”. | Text | 10 | Yes |

DebitCard.CardOnFile.Usage |

“First” if the card has been stored and it is your first use. “Used” if the card has been stored and it has been used previously in another transaction. Applicable to Provider Cielo only. |

Text | - | No |

DebitCard.CardOnFile.Reason |

Indicates the purpose of the card storage, in case the Usage field is “Used”.“Recurring” - Scheduled recurring purchase (e.g.: subscription services). “Unscheduled” - Unscheduled recurring purchase (e.g.: services apps). “Installments” - Installment through recurrence. Applicable to Provider Cielo only. |

Text | - | Conditional |

{

[...]

"Payment": {

"DebitCard": {

"CardNumber": "506722******0001",

"Holder": "Nome do Portador",

"ExpirationDate": "12/2021",

"SaveCard": false,

"Brand": "Elo"

"CardOnFile":{

"Usage":"Used",

"Reason":"Unscheduled"

},

"AcquirerTransactionId": "10069930690009D366FA",

"PaymentId": "21423fa4-6bcf-448a-97e0-e683fa2581ba",

"Type": "DebitCard",

"Amount": 10000,

"ReceivedDate": "2017-05-11 15:19:58",

"Currency": "BRL",

"Country": "BRA",

"Provider": "Cielo30",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

[...]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

[...]

"Payment": {

"DebitCard": {

"CardNumber": "506722******0001",

"Holder": "Nome do Portador",

"ExpirationDate": "12/2021",

"SaveCard": false,

"Brand": "Elo"

"CardOnFile":{

"Usage":"Used",

"Reason":"Unscheduled"

},

"AcquirerTransactionId": "10069930690009D366FA",

"PaymentId": "21423fa4-6bcf-448a-97e0-e683fa2581ba",

"Type": "DebitCard",

"Amount": 10000,

"ReceivedDate": "2017-05-11 15:19:58",

"Currency": "BRL",

"Country": "BRA",

"Provider": "Cielo30",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

[...]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AcquirerTransactionId |

Transaction ID of the payment method provider. | Text | 40 | Alphanumeric |

ProofOfSale |

Proof of sale reference. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code from the acquirer. | Text | 300 | Alphanumeric text |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReceivedDate |

Date the transaction was received by Braspag. | Text | 19 | YYYY-MM-DD HH:mm:SS |

ReasonCode |

Operation return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Operation return message. | Text | 512 | Alphanumeric |

Status |

Transaction status. | Byte | 2 | E.g.: 1 |

ProviderReturnCode |

Code returned by the payment provider (acquirer or issuer). | Text | 32 | 57 |

ProviderReturnMessage |

Message returned by the payment provider (acquirer or issuer). | Text | 512 | Transaction Approved |

With the authentication process, it is possible to carry out a risk analysis considering a greater amount of user and seller data, thus helping in the online purchase validation process. When validated correctly, the risk of chargeback (disputing a purchase made by credit or debit card) of the transaction is passed on to the issuer; that is, the merchant will not receive disputes.

The most current authenticator standard is 3DS 2.0, and the 3DS 1.0 version has been discontinued.

In addition to being compatible with different types of devices (desktop, tablet or smartphone), the 3DS 2.0 version has features that provide a better online shopping experience for your customer.

During the transaction flow, the authorization step can be performed separately or together with authentication. To learn more about the second flow, check out the documentation for Authorization with Authentication from 3DS 2.0.

The following tables apply to Mastercard and Hipercard credit and debit transactions with stored credentials. The objective is to identify whether the transaction was initiated by the cardholder or by the merchant:

The transaction initiator indicator must be sent in the node Payment.InitiatedTransactionIndicator, within parameters Category and Subcategory. Please refer to the following request example and tables for more information:

"Payment":{

(...)

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

(...)

}

"Payment":{

(...)

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

(...)

}

For the full request example see Creating a credit card transaction or Creating a debit transaction.

| Property | Type | Size | Required | Description |

|---|---|---|---|---|

Payment.InitiatedTransactionIndicator.Category |

string | 2 | Conditional. Required for Mastercard and Hipercard. | Transaction Initiator Indicator category. Valid for brands Mastercard and Hipercard. Possible values: - “C1”: transaction initiated by the cardholder; - “M1”: recurring payment or installment initiated by the merchant - “M2”: transaction initiated by the merchant. |

Payment.InitiatedTransactionIndicator.Subcategory |

string | - | Conditional. Required for Mastercard and Hipercard. | Transaction Initiator Indicator subcategory. Valid for brands Mastercard and Hipercard. Please refer to the Transaction Initiator Indicator tables for the full list. |

The response will be the default response for the credit or debit transaction, returning the node Payment.InitiatedTransactionIndicator as sent in the request.

The categories (C1, M1 or M2) must be sent in parameter Payment.InitiatedTransactionIndicator.Category.

| Category | Transaction initiator | Description |

|---|---|---|

C1 |

Cardholder-initiated transaction (CIT). | The transaction is initiated by the cardholder. The cardholder provides card data and agrees with the merchant storing payment credentials or makes a purchase using previously stored payment credentials. The subcategory will indicate the reason for the purchase or for storing card data. |

M1 |

Merchant-initiated transaction (MIT). | The merchant has stored the payment credentials in the past (tokenized and with cardholder consent) and is authorized to initiate one or more transactions in the future for recurrent payments or installments. |

M2 |

Merchant-initiated transaction (MIT). | The merchant has stored the payment credentials in the past (tokenized and with cardholder consent) and is authorized to initiate one or more transactions in the future in order to charge for partial deliveries, related/delayed expenses, no-show fees and retry/resubmission. |

The subcategories must be sent in parameter Payment.InitiatedTransactionIndicator.Subcategory.

| Initiator category | Initiator subcategory | Meaning | Example |

|---|---|---|---|

C1 |

CredentialsOnFile |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials or makes a purchase using previously stored payment credentials. | The cardholder initiates the purchase and the merchant is authorized to save card data for future purchases initiated by the cardholder, such as one-click-buy. |

C1 |

StandingOrder |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials for future payments of fixed amount and variable frequency. | Initial transaction to store card data for utility bills monthly payments. |

C1 |

Subscription |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials for recurrent payments of fixed amount and frequency. | Initial transaction to store card data for a monthly subscription (e.g .newspapers and magazines). |

C1 |

Installment |

Cardholder-initiated transaction in which the cardholder initiates the first installment and authorizes the merchant to save card data for the next installments. | Initial transaction to store card data for installment buying |

M1 |

CredentialsOnFile |

Merchant-initiated unscheduled transaction of fixed or variable amount. | When the cardholder agrees with transactions for toll charges when the balance in their account is below a certain amount (auto-recharge). |

M1 |

StandingOrder |

Merchant-initiated transaction of variable amount and fixed frequency. | Utility bills monthy payments. |

M1 |

Subscription |

Merchant-initiated transaction of fixed amount and fixed frequency. | Monthly subscription or fixed monthly service payment. |

M1 |

Installment |

Merchant-initiated transaction of known amount and defined period. | If a shopper buys a TV for $600 and chooses to pay in three $200 installments; in this situation, the first transaction is initiated by the cardholder and the following two transactions are initiated by the merchant. |

M2 |

PartialShipment |

Merchant-initiated transaction when the order will be delivered in more than one shipping. | Partial shipment may occur when the amount of purchased goods in the e-commerce is not available for shipping in the time of purchase. Each shipping is a separate transaction. |

M2 |

RelatedOrDelayedCharge |

Merchant-initiated transaction for additional expenses, i.e., additional charges after providing initial services and processing the payment. | A hotel minibar fridge charges after cardholder check-out. |

M2 |

NoShow |

Merchant-initiated transaction for no-show charges according to the merchant cancellation policy. | The cancellation of a reservation by the cardholder without adequate prior notice to the merchant. |

M2 |

Resubmission |

Merchant-initiated transaction for retrying previously denied transactions. | The previous attempt to submit a transaction was denied, but the issuer response does not prohibit the merchant to retry, such as insufficient funds/response above credit limit. |

Important: Card data is stored in encrypted format.

When a transaction is submitted with the Payment.Capture parameter as “false”, there is the need of a later request for capturing the transaction, in order for it to be confirmed.

An authorization that is not captured by the deadline is automatically released by the acquirer. Merchants may have specific negotiations with the acquirers to change their capturing deadline. For further information about capture deadlines and refund, you can refer to this article, in Portuguese.

--request PUT "https://apisandbox.braspag.com.br/v2/sales/{PaymentId}/capture?amount=xxx&serviceTaxAmount=xxx"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--verbose

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

MerchantId |

Store identifier in the API. | GUID | 36 | Yes (through header) |

MerchantKey |

Public key for dual authentication in the API. | Text 40 | Yes (through header) | |

RequestId |

Store-defined request identifier used when the merchant uses different servers for each GET/POST/PUT. | GUID | 36 | No (through header) |

PaymentId |

Order identifier field. | GUID | 36 | Yes (through endpoint) |

Amount |

Amount to be captured, in cents. The support for partial capture must be verified with the acquirer. | Number | 15 | No |

ServiceTaxAmount |

Applicable to airlines. Amount of the authorization to be allocated to the service charge. Note: This value is not added to the authorization value. | Number | 15 | No |

{

"Status": 2,

"ReasonCode": 0,

"ReasonMessage": "Successful",

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/{PaymentId}/void"

}

]

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"Status": 2,

"ReasonCode": 0,

"ReasonMessage": "Successful",

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.braspag.com.br/v2/sales/{PaymentId}/void"

}

]

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

Status |

Transaction status. | Byte | 2 | E.g.: 1 |

ReasonCode |

Acquirer return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Acquirer return message. | Text | 512 | Alphanumeric |

The availability of the refunding service varies depending on the acquirer. Each acquirer has its own deadlines to allow the refund of a transaction. In this article, written in Portuguese, you can check each of them.

To cancel a credit card transaction, you must send an HTTP message through the PUT method to the Payment resource, as in the example:

--request PUT "https://apisandbox.braspag.com.br/v2/sales/{PaymentId}/void?amount=xxx"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--verbose

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

MerchantId |

Store identifier in the API. | GUID | 36 | Yes (through header) |

MerchantKey |

Public key for dual authentication in the API. | Text | 40 | Sim (through header) |

RequestId |

Store-defined request identifier used when the merchant uses different servers for each GET/POST/PUT. | GUID | 36 | No (through header) |

PaymentId |

Order identifier field. | GUID | 36 | Yes (through endpoint) |

Amount |

Amount to be canceled/refunded, in cents. Note: 1. Check if your acquirer supports the cancelling or refunding of operations. 2. If the value for Amount is “0” (zero), or if Amount is not sent, the refund will consider the total captured amount. |

Number | 15 | No (through endpoint) |

{

"Status": 10,

"ReasonCode": 0,

"ReasonMessage": "Successful",

"ProviderReturnCode": "9",

"ProviderReturnMessage": "Operation Successful",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/{PaymentId}"

}

]

}

{

"Status": 10,

"ReasonCode": 0,

"ReasonMessage": "Successful",

"ProviderReturnCode": "9",

"ProviderReturnMessage": "Operation Successful",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.braspag.com.br/v2/sales/{PaymentId}"

}

]

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

Status |

Transaction status. | Byte | 2 | E.g.: 1 |

ReturnCode |

Acquirer’s return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Acquirer’s return message. | Text | 512 | Alphanumeric |

Velocity Check is a fraud-fighting tool that prevents massive bursts of transactions with repeated payment data. It analyzes the frequency of traceability elements such as Card Number, Social Security Number, Zip Code, among others, and blocks suspicious transactions.

The functionality must be contracted separately and then enabled in your store via dashboard. When Velocity is active, the transaction response brings in the Velocity node, with details of the analysis.

In case of a Velocity rule rejection, ProviderReasonCode will be “BP 171 - Rejected by fraud risk” (Velocity, with “ReasonCode 16 - AbortedByFraud”).

{

[...]

"VelocityAnalysis": {

"Id": "2d5e0463-47be-4964-b8ac-622a16a2b6c4",

"ResultMessage": "Reject",

"Score": 100,

"RejectReasons": [

{

"RuleId": 49,

"Message": "Blocked by the CardNumber rule. Name: Maximum 3 Card Hits in 1 day. HitsQuantity: 3. HitsTimeRangeInSeconds: 1440. ExpirationBlockTimeInSeconds: 1440"

}]

[...]

}

}

{

[...]

"VelocityAnalysis": {

"Id": "2d5e0463-47be-4964-b8ac-622a16a2b6c4",

"ResultMessage": "Reject",

"Score": 100,

"RejectReasons": [

{

"RuleId": 49,

"Message": "Blocked by the CardNumber rule. Name: Maximum 3 Card Hits in 1 day. HitsQuantity: 3. HitsTimeRangeInSeconds: 1440. ExpirationBlockTimeInSeconds: 1440"

}]

[...]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

VelocityAnalysis.Id |

Identification of the analysis performed. | GUID | 36 | |

VelocityAnalysis.ResultMessage |

Analysis result (“Accept” / “Reject”). | Text | 25 | |

VelocityAnalysis.Score |

Number of points given to the operation. E.g.: 100. | Number | 10 |

The Dynamic Currency Conversion (DCC) is a currency converter from the Global Payments acquirer that allows a foreign cardholder to choose between paying in reais or in their local currency, converting the order amount at the time of purchase with full transparency for the customer. The solution is suitable for establishments such as hotels, inns, shopping centers and tourist shops, that receive payments with cards issued abroad.

When the establishment has DCC product enabled, the authorization process is performed in the 3 steps described below:

In the first step, when applying for an authorization with an international card, Global Payments identifies the card’s country and applies the currency conversion following the brand-specific calculations, and then returns the conversion information.

There is no difference between a standard authorization request and a DCC authorization request.

{

[...]

},

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "123412******1234",

"Holder": "Shopper Test",

"ExpirationDate": "12/2022",

"SaveCard":"false",

"Brand":"Visa",

},

"ReturnUrl": "http://www.braspag.com.br/",

"PaymentId": "fa0c3119-c730-433a-123a-a3b6dfaaad67",

"Type":"CreditCard",

"Amount": 100,

"ReceivedDate": "2018-08-23 10:46:25",

"Currency":"BRL",

"Country":"BRA",

"Provider": "GlobalPayments",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 12,

"ProviderReturnCode": "0",

"ProviderReturnMessage": "Authorized Transaction",

"CurrencyExchangeData": {

"Id": "fab6f3a752d700af1d50fdd19987b95df497652b",

"CurrencyExchanges": [{

"Currency": "EUR",

"ConvertedAmount": 31,

"ConversionRate": 3.218626,

"ClosingDate": "2017-03-09T00:00:00"

},

{

"Currency":"BRL",

"ConvertedAmount": 100

}

]

},

[...]

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

[...]

},

"Payment":{

"ServiceTaxAmount":0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "123412******1234",

"Holder": "Shopper Test",

"ExpirationDate": "12/2022",

"SaveCard":"false",

"Brand":"Visa",

},

"ReturnUrl": "http://www.braspag.com.br/",

"PaymentId": "fa0c3119-c730-433a-123a-a3b6dfaaad67",

"Type":"CreditCard",

"Amount": 100,

"ReceivedDate": "2018-08-23 10:46:25",

"Currency":"BRL",

"Country":"BRA",

"Provider": "GlobalPayments",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 12,

"ProviderReturnCode": "0",

"ProviderReturnMessage": "Authorized Transaction",

"CurrencyExchangeData": {

"Id": "fab6f3a752d700af1d50fdd19987b95df497652b",

"CurrencyExchanges": [{

"Currency": "EUR",

"ConvertedAmount": 31,

"ConversionRate": 3.218626,

"ClosingDate": "2017-03-09T00:00:00"

},

{

"Currency":"BRL",

"ConvertedAmount": 100

}

]

}

[...]

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AcquirerTransactionId |

Transaction ID of the payment method provider. | Text | 40 | Alphanumeric |

ProofOfSale |

Proof of sale number. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code. | Text | 300 | Alphanumeric |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReceivedDate |

Date the transaction was received by Braspag. | Text | 19 | YYYY-MM-DD HH:mm:SS |

ReasonCode |

Operation return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Operation return message. | Text | 512 | Alphanumeric |

Status |

Transaction status. | Byte | 2 | E.g.: 12 |

ProviderReturnCode |

Code returned by the payment provider (acquirer or issuer). | Text | 32 | 57 |

ProviderReturnMessage |

Message returned by the payment provider (acquirer or issuer). | Text | 512 | Transaction Approved |

CurrencyExchangeData.Id |

ID of the currency exchange action. | Text | 50 | 1b05456446c116374005602dcbaf8db8879515a0 |

CurrencyExchangeData.CurrencyExchanges.Currency |

Customer’s local currency/credit card. | Numeric | 4 | EUR |

CurrencyExchangeData.CurrencyExchanges.ConvertedAmount |

Converted value. | Numeric | 12 | 23 |

CurrencyExchangeData.CurrencyExchanges.ConversionRate |

Conversion rate. | Numeric | 9 | 3.218626 |

CurrencyExchangeData.CurrencyExchanges.ClosingDate |

Transaction end date. | Texto | 19 | AAAA-MM-DD HH:mm:SS |

CurrencyExchangeData.CurrencyExchanges.Currency |

Real currency code. | Text | 3 | BRA |

CurrencyExchangeData.CurrencyExchanges.ConvertedAmount |

Order value in reais. | Numeric | 12 | 100 |

In the second step, the store system will present the customer with the options of paying in reais or in their country’s currency (credit card currency), following the best practices requested by the brand. The text is presented in English and the website layout does not need to be changed, as long as the currency selection options follow the same font, color and dimension characteristics.

In Global Payments, the payment options (in reais or in the card currency) are displayed on the screen, right beside a summary of the purchase.

In the third step, the store system sends the transaction confirmation with the information of the currency chosen by the customer. At this point, the authorization response is returned.

{

"Id": "1b05456446c116374005602dcbaf8db8879515a0",

"Currency": "EUR",

"Amount": 23

}

--request POST " https://apisandbox.braspag.com.br/v2/sales/{PaymentId}/confirm"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"Id": "1b05456446c116374005602dcbaf8db8879515a0",

"Currency": "EUR",

"Amount": 23

}

--verbose

| Property | Description | Type | Size | Required? |

|---|---|---|---|---|

Id |

ID of the currency exchange action. | Text | 50 | Yes |

Currency |

Customer’s selected currency. | Numeric | 4 | Yes |

Amount |

Converted value. | Numeric | 12 | Yes |

{

[...]

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest":"ByMerchant",

"Capture": false,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "123412******1234",

"Holder": "TestDcc",

"ExpirationDate": "12/2022",

"SecurityCode": "***",

"Brand":"Visa",

},

"ProofOfSale": "20170510053219433",

"AcquirerTransactionId": "0510053219433",

"AuthorizationCode": "936403",

"SoftDescriptor":"Message",

"PaymentId": "fa0c3119-c730-433a-123a-a3b6dfaaad67",

"Type":"CreditCard",

"Amount": 23,

"ReceivedDate": "2017-05-10 17:32:19",

"CapturedAmount": 23,

"CapturedDate": "2017-05-10 17:32:19",

"Currency":"BRL",

"Country":"BRA",

"Provider": "GlobalPayments",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

[...]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

[...]

"Payment":{

"ServiceTaxAmount": 0,

"Installments":1,

"Interest":"ByMerchant",

"Capture": false,

"Authenticate":false,

"Recurrent":false,

"CreditCard":{

"CardNumber": "123412******1234",

"Holder": "TestDcc",

"ExpirationDate": "12/2022",

"SecurityCode": "***",

"Brand":"Visa",

},

"ProofOfSale": "20170510053219433",

"AcquirerTransactionId": "0510053219433",

"AuthorizationCode": "936403",

"SoftDescriptor":"Message",

"PaymentId": "fa0c3119-c730-433a-123a-a3b6dfaaad67",

"Type":"CreditCard",

"Amount": 23,

"ReceivedDate": "2017-05-10 17:32:19",

"CapturedAmount": 23,

"CapturedDate": "2017-05-10 17:32:19",

"Currency":"BRL",

"Country":"BRA",

"Provider": "GlobalPayments",

"ReasonCode": 0,

"ReasonMessage": "Successful",

"Status": 2,

"ProviderReturnCode": "6",

"ProviderReturnMessage": "Operation Successful",

[...]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AcquirerTransactionId |

Transaction ID of the payment method provider. | Text | 40 | Alphanumeric |

ProofOfSale |

Proof of sale number. | Text | 20 | Alphanumeric |

AuthorizationCode |

Authorization code. | Text | 300 | Alphanumeric |

PaymentId |

Order identifier field. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReceivedDate |

Date the transaction was received by Braspag. | Text | 19 | YYYY-MM-DD HH:mm:SS |

ReasonCode |

Operation return code. | Text | 32 | Alphanumeric |

ReasonMessage |

Operation return message. | Text | 512 | Alphanumeric |

Status |

Transaction status. | Byte | 2 | E.g.: 12 |

ProviderReturnCode |

Code returned by the payment provider (acquirer or issuer). | Text | 32 | 57 |

ProviderReturnMessage |

Message returned by the payment provider (acquirer or issuer). | Text | 512 | Transaction Approved |

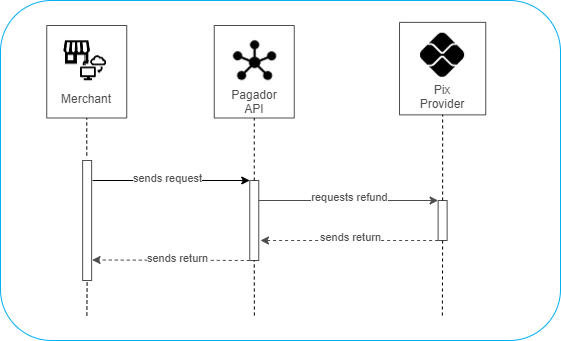

In Pix, the transmission of the payment order and the availability of funds to the receiving user takes place in real time, 24 hours a day and without the need for intermediates. Thus, it is a type of payment method that enables fast payments with lower transaction costs.

The life cycle of a Pix transaction:

| SEQUENCE | RESPONSIBLE | DESCRIPTION | TRANSACTION STATUS |

|---|---|---|---|

| 1 | Store | Generates the QR Code. | 12 - Pending |

| 2 | Shopper | Pays QR Code. | 2 - Paid |

| 3 | Store | Receives payment confirmation notification. | 2 - Paid |

| 4 | Store | Queries the transaction status. | 2 - Paid |

| 5 | Store | Releases order. | 2 - Paid |

| 6 | Store | If necessary, requests refund of the Pix transaction (similar to card refund). | 2 - Paid |

| 7 | Store | Receives refund confirmation notification. | 11 - Refunded |

| * | Store | Queries the transaction status. | 11 - Refunded |

You can generate a Pix QR code through the API Pagador by simply perform the integration as specified below.

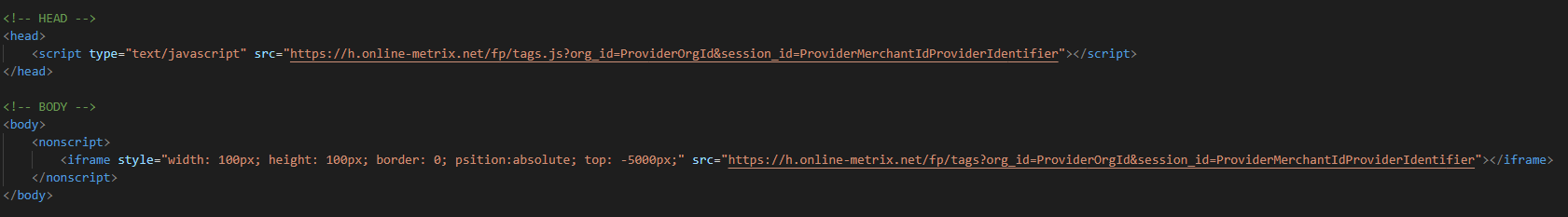

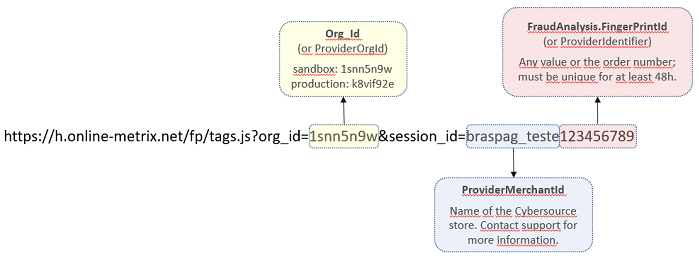

Among the required request fields, two stand out: Type, which must be sent as “Pix”; and `Provider’, which must be “Cielo30” or “Bradesco2”. The response for the request will return the base64 encoded QR Code Pix image, which must be made available to the shopper.

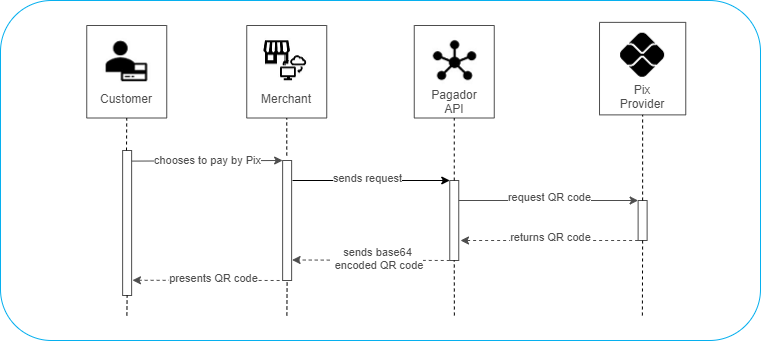

See below the representation of the transactional flow in QR code Pix generation:

The shopper then performs the QR code reading through one of the Pix payment enabled applications and makes the payment. In this step, there is no participation of the store or Braspag, as shown below:

Here are examples of a request and response for generating the QR code Pix:

{

"MerchantOrderId":"2020102601",

"Customer":{

"Name":"Nome do Pagador",

"Identity":"12345678909",

"IdentityType":"CPF"

},

"Payment":{

"Type":"Pix",

"Provider":"Bradesco2",

"Amount":100,

"QrCodeExpiration":86400

}

}

--request POST "https://(...)/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2020102601",

"Customer":{

"Name":"Nome do Pagador",

"Identity":"12345678909",

"IdentityType":"CPF"

},

"Payment":{

"Type":"Pix",

"Provider":"Bradesco2",

"Amount":100,